Entrepreneurs say the sea plants can replace fuels, plastics, textiles, animal feeds, cosmetics, fertilizers and supplements

Seaweed is becoming ubiquitous, used in foods ranging from butter and pasta to pickles and salsa but it’s not a voracious appetite for fast-growing underwater greens that has global seaweed cultivation poised to top 82,727 kilotons in the next decade.

Interest in industrial applications for seaweed are helping drive demand. Companies are pursuing products like biofuels, bioplastics, textiles, animal feed, cosmetics, fertilizers and supplements.

“There is a lot of hype because there is a lot of promise in seaweed in terms of how it can help the environment and the products you can produce from it,” said Loretta Roberson, associate scientist at the University of Chicago Marine Biological Laboratory.

Investments in seaweed startups doubled in 2021, topping $168 million, according to a new report. Companies are in various stages of development from research and preproduction to more mature aquaculture companies producing up to 100,000 tons of seaweed per year for industrial uses.

A focus on fuel

Currently, corn and other biomasses generate an estimated 5 percent of energy use in the United States but concerns about the amount of land, fertilizer and freshwater used to produce ethanol has sparked interest in alternatives. Seaweed has major potential.

“You can grow [seaweed] without using valuable land resources,” Roberson said. “You don’t need freshwater or land or fertilizer and it removes excess nutrients like carbon from the environment.”

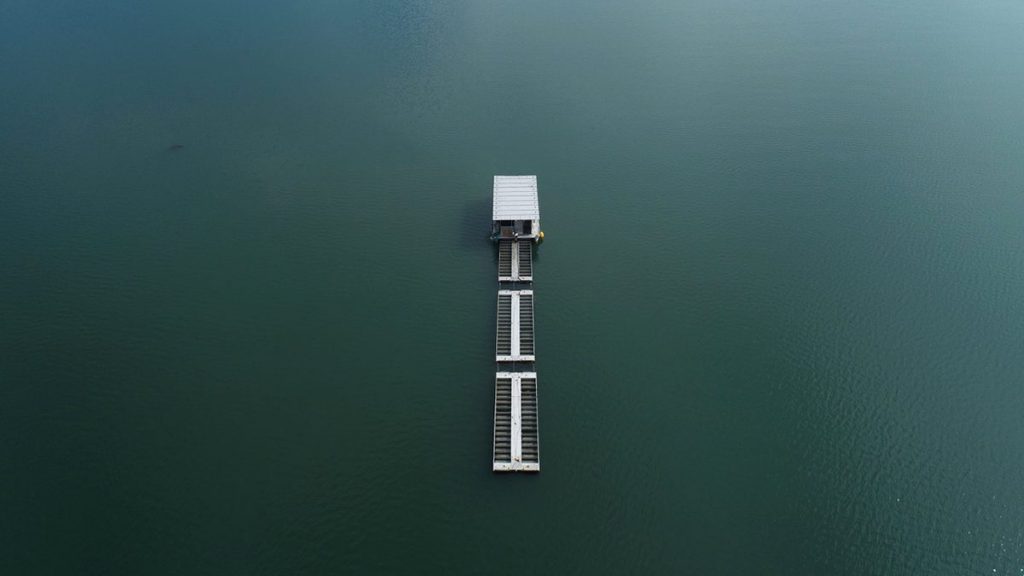

The Advanced Research Projects Agency-Energy (ARPA-E), an agency within the U.S. Department of Energy, created the Microalgae Research Inspiring Novel Energy Resources (MARINER) program to fund several marine biomass projects, including biofuel production from kelp. The goal is to create open ocean kelp farms and convert the kelp to carbon-neutral biocrude.

Several startups and academic institutions are also researching the potential of seaweed-based biofuels. In California, researchers at the USC Wrigley Institute for Environmental Studies are testing a new aquaculture technique that uses “kelp elevators” to optimize seaweed growth in coastal waters.

Their data showed that Macrocystis pyrifera, the species of kelp grown in the open ocean kelp farms, had an average growth rate of 5 percent per day and produced four times more biomass than kelp grown in natural beds.

Exploring the relevancy, resiliency and scalability of seaweed farming at Seagriculture

The future of feed

In 2017, seaweed made headlines when research showed that adding the tropical seaweed Asparagopsis taxiformi to cattle feed helped reduce methane emissions in cow burps up to 50 percent. Several companies started developing sea plants in the hopes of reducing the climate impacts of cattle production.

Symbrosia, the Hawaiian startup that developed SeaGraze – a seaweed additive made with Asparagopsis taxiformis – to reduce methane emissions in cattle belches has raised almost $8.5 million in funding.

Moving from research and development into production required developing a seed bank, determining pest and disease resistance, and optimizing growth for a seaweed species that had not been farmed in the past.

“It was a full-scale aquaculture project,” explained founder and CEO Alexia Akbay, who pointed to climate targets set by beef and dairy producers as the main driver of demand.

“The majority of their emissions are coming from [cattle belches] and there are currently no products on the market to reduce that source of emissions,” she said.

Seaweed has other benefits as a feed additive for cattle, including improved digestion and use of forage, coat health and disease management, she adds.

To date, Symbrosia has several signed contracts with farmers who want to purchase the dried, pelletized seaweed to add to their cattle feed; Akbay is also focused on scaling production to meet the demand and hopes to identify other seaweed species that could be farmed and used in feed additives.

Interest in seaweed as a feedstock or additive has expanded beyond terrestrial farming. TransAlgae is using seaweed means of delivering oral vaccines to farmed fish.

Instead of administering individual vaccines via injection, a process that requires significant time and generates a lot of plastic waste, the Israeli biotech startup developed algal powder (from an undisclosed species of algae) containing a vaccine to protect against Iridovirus in aquaculture species.

Top global animal health companies have tested the product, which showed a 90 percent survival rate from Iridovirus compared to 40 percent of fish in an unvaccinated control group. TransAlgae is also working on developing two additional oral vaccines for fish and targeting a 2026 commercial release.

“There are other companies trying to mimic our platform but we’re the only ones that have a proven solution,” says Ofra Chen, deputy CEO and CTO. “It’s going to bring a breakthrough solution to the aquaculture market.”

Plastic alternatives

Global plastic waste tops per year and an estimated 85 percent of those single-use plastic products from straws to sandwich bags end up in the landfill. The need to find alternatives has led several startups to experiment with seaweed-based bioplastics.

“If we can stop the use of fossil fuels in the production of plastics, making the whole process more sustainable and producing materials that are at least compostable, it will be a big benefit,” said Roberson.

Companies like UK-based Kelpi and Notpla use seaweed to make biodegradable, compostable, low-carbon bioplastic packaging materials from bags and condiment pouches to takeout containers. In California, Sway makes flexible, thin-film plastic packaging alternatives from farmed seaweed, noting, “regenerative seaweed farms can uplift coastal communities harmed by the climate crisis.”An estimated 35 startups are working on seaweed bioplastics solutions. More than half of the finalists in the TOM FORD Plastic Innovation Prize, a new global competition awarding $1.2 million in prizes for scalable and degradable alternatives to thin film polybags, used seaweed in their products.

Getting industrial

While there are a lot of exciting innovations in industrial seaweed applications, Roberson believes there is a long road to achieving commercialization.

“We’re still in the very early stages,” she said. “We’re not able to go to the scale right now that we need to be at to do all of these different things that we want to do.”

The biggest barriers are production and processing. Seaweed farms must scale up to produce enough biomass to use in biofuels, bioplastics, animal feed and other industrial products; the onerous permitting process, especially in the United States, makes it difficult to start or expand farms. Lack of processing facilities is another roadblock.

Research is also ongoing into the potential environmental impacts of large-scale, offshore seaweed farms.

“At scale, if we have these massive seaweed farms soaking up all of these nutrients in an environment where there are phytoplankton and other organisms that depend on phytoplankton, we’ll shut down those other ecosystems,” said Roberson. “It’s a question of carrying capacity [and] I don’t think we know enough about the nearshore and offshore dynamics and how seaweed farms will impact those on a large scale.”

Follow the Advocate on Twitter @GSA_Advocate

Now that you've reached the end of the article ...

… please consider supporting GSA’s mission to advance responsible seafood practices through education, advocacy and third-party assurances. The Advocate aims to document the evolution of responsible seafood practices and share the expansive knowledge of our vast network of contributors.

By becoming a Global Seafood Alliance member, you’re ensuring that all of the pre-competitive work we do through member benefits, resources and events can continue. Individual membership costs just $50 a year.

Not a GSA member? Join us.

Author

-

Jodi Helmer

Jodi Helmer is a North Carolina-based journalist covering the business of food and farming.

Tagged With

Related Posts

Responsibility

Lean and green, what’s not to love about seaweed?

Grown for hundreds of years, seaweed (sugar kelp, specifically) is the fruit of a nascent U.S. aquaculture industry supplying chefs, home cooks and inspiring fresh and frozen food products.

Responsibility

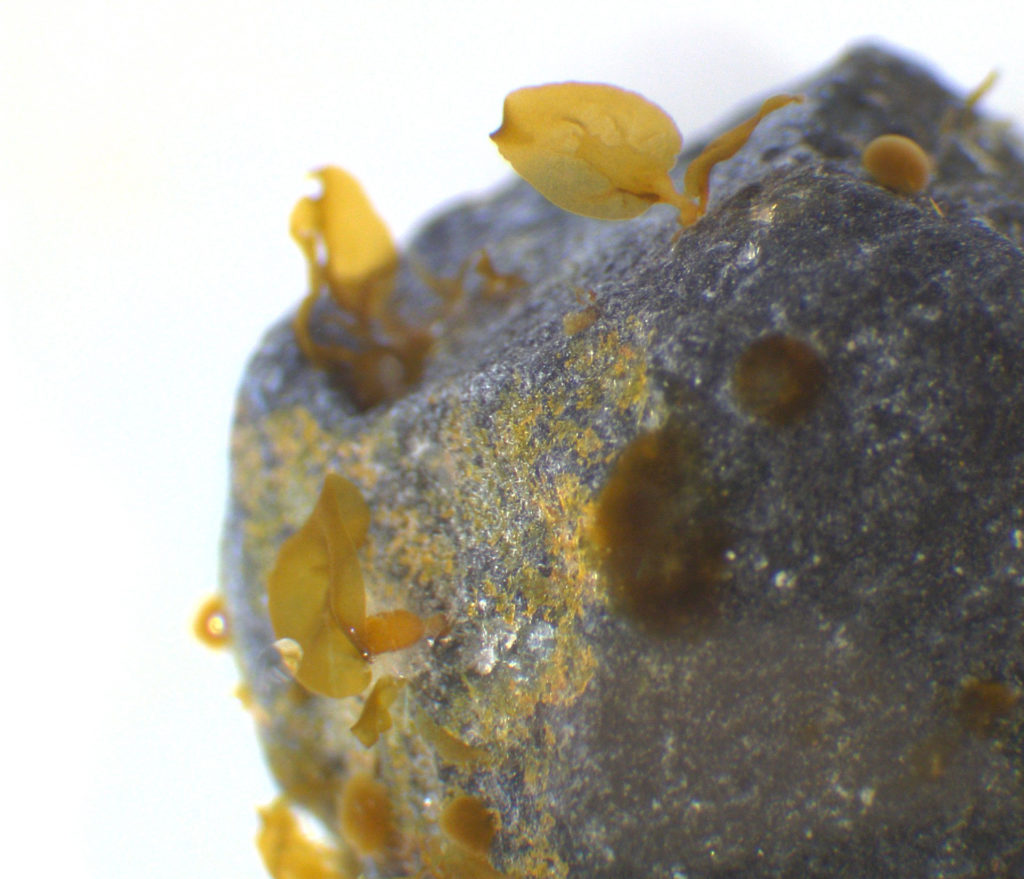

Kelp parachutes: Green gravel reforestation projects showing promise

Researchers are growing kelp seedlings on ‘green gravel’ and then scattering them on the ocean floor, where they’ll hopefully anchor and flourish.

Innovation & Investment

This Maine company thinks kelp buoys and oyster farming can save the ocean through carbon capture and sequestration

Maine-based Running Tide uses carbon-capture and oyster farming techniques – using both low and high technology – to restore ocean health.

Responsibility

All clams on deck: How restorative aquaculture can repair Florida estuaries

New legislation aims to tackle tough environmental issues in Florida estuaries by bolstering the number of clams and seagrass through restorative aquaculture.