In DLG’s first foray outside of Europe, the conference topics spanned biology, business, engineering and – finally – food

Seaweed farming is a growing industry globally, with seemingly vast potential as a food source, as a biofuel, as a fertilizer, as a component of medicinal and cosmetic products – and possibly part of wider climate change solutions for the planet’s carbon crisis.

It’s just not growing fast enough and despite its widely touted environmental benefits – which are now being more closely examined – permitting, production costs, processing infrastructure and scalability are significant obstacles.

Those were the big takeaways from Seagriculture, the world’s first international seaweed conference, which for the first time took place outside of Europe.

Held last week in Portland, Maine, USA – where about 85 percent of the U.S. farmed seaweed supply is produced and where much seaweed research has been conducted – the event hit on the crucial topics facing a nascent industry with a list of needs as long as the number of people and businesses counting on its success. Investment capital, scalable production technologies and, perhaps most importantly, eager markets are the top priorities. Here are some highlights from the two-day event.

Like a good neighbor

A major factor determining the future of seaweed farming is public support, and the pressing need to establish social license to operate. Charles Yarish, professor emeritus at the University of Connecticut, said in his keynote address that the ecosystem services of seaweed farming are what makes seaweed farming “relevant” and worthy of further research, public trust and investment.

Yarish noted that the United States sits outside the top 20 list of global seaweed producers, with about 1.7 million pounds of production (wet weight). Requiring no fertilizer and no freshwater to grow, Yarish said that seaweed farming still faces a raft of obstacles impeding its growth: Coastal zone conflicts, permitting, compliance, cost reduction, processing, food safety, workforce development and the aforementioned social license.

Sitting above all of those challenges, however, is climate change: “Temperature is the big elephant in the room,” said Yarish. “With climate change, we have to have resilience” with seed stocks and production systems.”

Scale is essential

Dr. Simon Freeman, program director at ARPA-E (Advanced Research Projects Agency, affiliated with the U.S. Department of Energy), said the opportunity facing U.S. seaweed production is massive: By 2050, the world will need 30 percent more energy and 50 to 100 percent more food, he added. With the second-largest exclusive economic zone (EEZ) in the world, and with abundant light, water and deep-water nutrients, U.S. waters are particularly well-suited for seaweed aquaculture. To characterize the opportunity and space needed for seaweed farming, Freeman said that by using just 1.6 percent of the EEZ, the United States could produce a gigaton of seaweed.

“Carbon sequestration needs to be one of the biggest industries on the planet,” said Freeman. “Small things are not going to work.”

Alison Myers, president of the Fearless Fund, noted that “all seaweed growers are carbon farmers.” Most seaweeds are 30 percent carbon, she added, and that carbon dioxide concentrations in the ocean are 70 times higher than in the atmosphere, highlighting the important role that seaweed plays in sequestering carbon.

Just how effective seaweed is at sequestering carbon remains a bit of a question, as any mentions of controversial methodologies – like sinking seaweed to the sea floor and making long-lived products from the biomass, such as biochar – earned some groans and pointed questions from the audience throughout the conference.

A ‘limited roadmap’

With five to 12 agencies having a say in seaweed-farm siting applications, California presents an interesting case study for the challenges that await producers before a single grow line is set in the water. Getting approvals from agencies at the local, state and federal level is a cost- and time-intensive exercise and there is a “limited road map” for prospective producers, according to Eliza Harrison, program manager at Ocean Rainforest.

Harrison detailed a seaweed farming project in Santa Barbara, Calif., that had many obstacles thrown its way. In the process of overcoming them, Ocean Rainforest learned that seaweed farms must be scalable, sustainable, survivable, predictable and profitable, said Harrison, but above all they must be accepted by other ocean stakeholders, like shipping and fishing.

“Commercial fishing needs to be engaged early on,” said Harrison. “If they feel they have a seat at the table they’re more open” to collaboration.

The National Oceanic and Atmospheric Administration (NOAA), for its part, is using spatial analysis and “big data” to help guide seaweed farmers in choosing new sites to develop, for ecological reasons and as a first step in avoiding potential conflicts like marine mammal entanglements. James Morris, Jr., marine ecologist at NOAA, talked about the agency’s efforts to crunch data to map U.S. waters for multiple functions.

“We have 33 million data layers we analyze to find the right space for your ocean industry,” said Morris, referring to NOAA’s AquaData Catalog, which includes five areas for aquaculture mapping. The agency released two maps for “Aquaculture Opportunity Areas” in 2021, one for the Gulf of Mexico and one for Southern California. Explaining this computer modeling process for creating seafood farming “atlases” to the public can get confusing, so Morris refers to the work as “intelligence gathering.”

A seaweed frontier

Julie Decker, executive director of the Alaska Fisheries Development Foundation, said interest in seaweed farming has grown tremendously since Alaska launched a mariculture initiative in 2013, encouraging greater seaweed and shellfish farming in an effort to enhance and restore ocean ecosystems. Most of the state’s new farming entrants are more interested in seaweed than shellfish, said Decker.

“One reason why my group was drawn to it is that it’s very complementary to the seafood industry,” she said.

Interestingly, Decker noted that new groups like the Alaska Mariculture Alliance are finding that seaweed farms in the state can are becoming an attractive partner for the tourism industry.

As the industry scales, Alaska producers, she added, are focused on reducing costs: “The cost to produce is high because we’re all learning,” she said, saying that understanding the fundamental economic issues of launching a new industry and collaborating with Indigenous and rural communities in the state was key.

“The development of the industry needs to be balanced with responsibility; the urgency needs to be balanced with equity,” Decker said.

Skepticism steps in

Marc von Keitz, director at The Grantham Foundation for the Protection of the Environment, kicked off a discussion about the limited funding for ocean projects, despite what he referred to as a really strong “hype cycle” for seaweed farming that has permeated scientific literature and media coverage.

“Two or three years ago, there were only very enthusiastic reports about seaweed and its ability to avert catastrophe,” said von Keitz. “Recently, there’s more skepticism or at least a closer look. What it comes down to, from the critics, is it’s too expensive, not scalable enough,” and there are significant questions about how seaweed competes with phytoplankton for nutrients, limits on seaweed’s atmospheric carbon capture potential and the unknown fate of sinking seaweed to the sea floor for carbon storage.

“Biochar from seaweed is not really what I’d recommend unless you have very large quantities of heat available to dry it” for low or no cost, he said. And the science behind sinking seaweed to the sea floor, or even burying it, in an effort to store carbon is not fully understood.

“The ocean is underinvested. It’s still a matter of cobbling things together,” he said, also noting a need for greater collaboration among those in the audience. “We have to push the scientific part and the technical part forward and talk more.”

Bailey Moritz, aquaculture program officer for the World Wildlife Fund, agreed that there’s “not enough true science” to back up the claims behind sinking seaweed. She also warned against growing the industry too fast.

“There can be no boom and bust. It must be sustainable, profitable, real and long-term,” she said.

‘Small business at its best’

The final speaker was Briana Warner, CEO of Atlantic Sea Farms in Maine, which is focused on diversifying the state’s working waterfront by recruiting lobster fishermen who need an off-season revenue stream to lease an area to cultivate sugar kelp. Atlantic Sea Farms guarantees that every blade of they produce will be bought.

With a company tagline of “Good food should do good,” Atlantic Sea Farms is responsible for galvanizing 27 fishermen/farmers to produce 1 million pounds of seaweed in a year and for creating a branded line of seaweed products that is selling via a range of supermarkets (1,700 stores across the United States) and foodservice channels.

“The hard work and grit of the people who work on the water, that’s the exciting story about seaweed,” said Warner. “There’s one thing that drives our [coastal] economy north of Portland and it’s lobster. We value that as Mainers, that identity. There are 4,000-plus license holders in the state, it’s very much small business at its best.”

But Warner noted that lobsters are under threat in Maine waters and that “nothing will replace it” for commercial fishermen. And while the Atlantic Sea Farms network of growers is finding success, it’s up to her company to answer the really big question.

“At the end of the day, we’re trying to answer, ‘How do you sell it?’”

Seagriculture is produced by DLG Benelux, part of the German Agricultural Society. According to Managing Director Bernd Koch, DLG members are “future-oriented farmers” whose collective goal is to “spread progress.” The event in Portland fielded 300 attendees from 11 countries, he said. The next Seagriculture event will take place in Trondheim, Norway, next June.

Follow the Advocate on Twitter @GSA_Advocate

Now that you've reached the end of the article ...

… please consider supporting GSA’s mission to advance responsible seafood practices through education, advocacy and third-party assurances. The Advocate aims to document the evolution of responsible seafood practices and share the expansive knowledge of our vast network of contributors.

By becoming a Global Seafood Alliance member, you’re ensuring that all of the pre-competitive work we do through member benefits, resources and events can continue. Individual membership costs just $50 a year.

Not a GSA member? Join us.

Author

-

James Wright

Editorial Manager

Global Seafood Alliance

Portsmouth, NH, USA[103,114,111,46,100,111,111,102,97,101,115,108,97,98,111,108,103,64,116,104,103,105,114,119,46,115,101,109,97,106]

Tagged With

Related Posts

Responsibility

Lean and green, what’s not to love about seaweed?

Grown for hundreds of years, seaweed (sugar kelp, specifically) is the fruit of a nascent U.S. aquaculture industry supplying chefs, home cooks and inspiring fresh and frozen food products.

Intelligence

Kelp is the climate-friendly crop that could

Kelp aquaculture is poised for growth on both U.S. coasts, but one grower network in Maine is building a brand and demand for domestic seaweed.

Responsibility

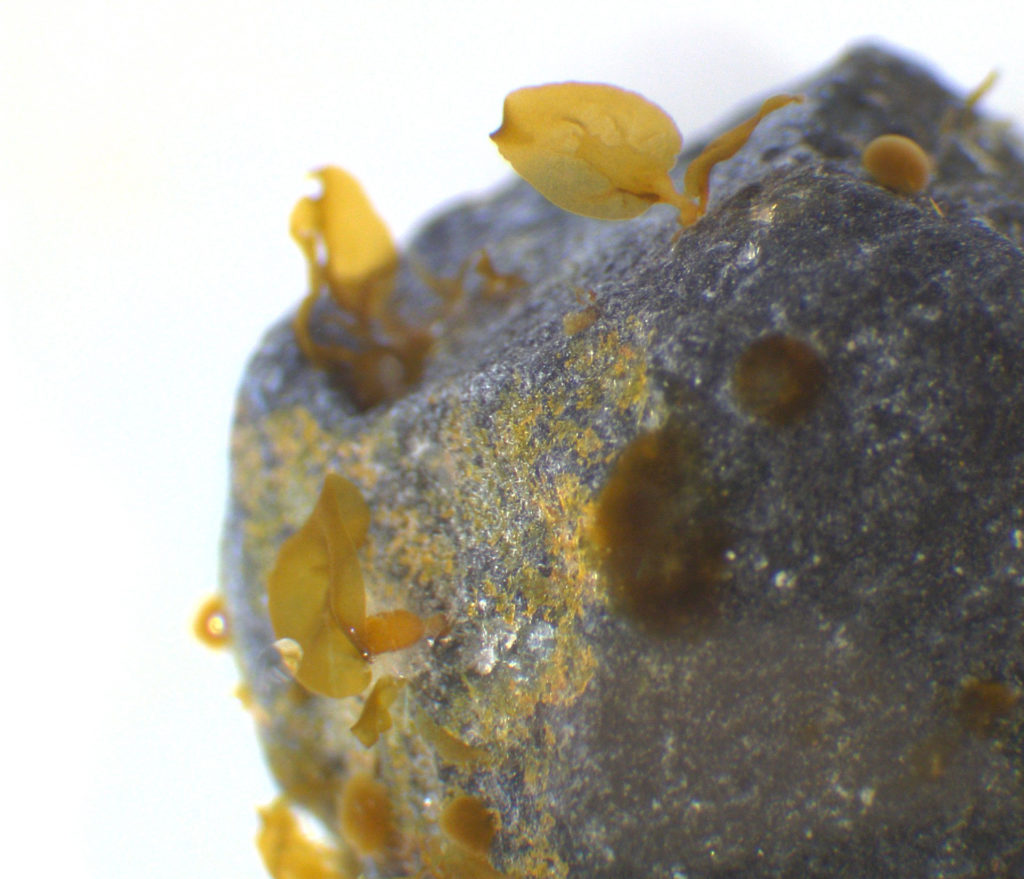

Kelp parachutes: Green gravel reforestation projects showing promise

Researchers are growing kelp seedlings on ‘green gravel’ and then scattering them on the ocean floor, where they’ll hopefully anchor and flourish.

Innovation & Investment

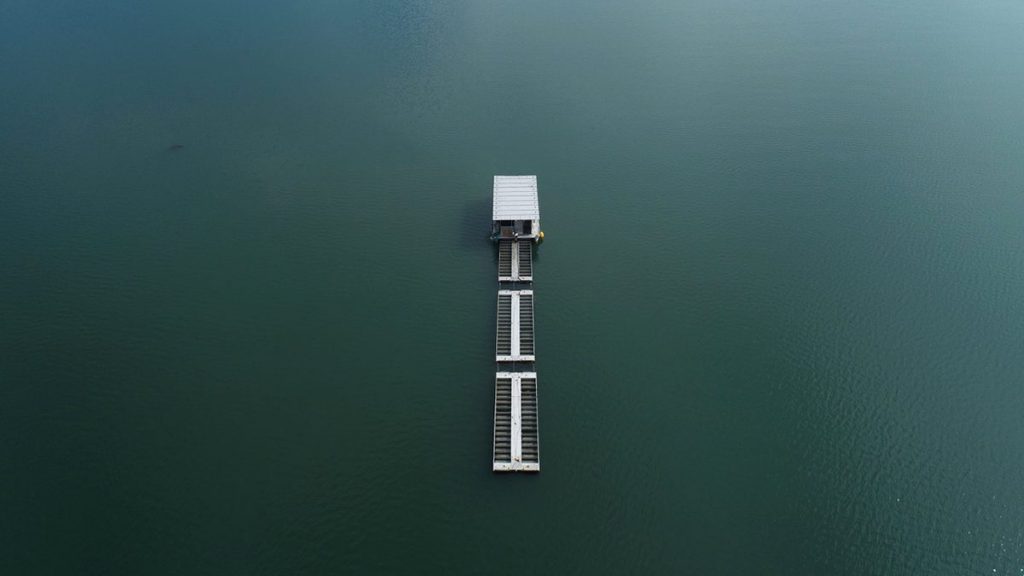

This Maine company thinks kelp buoys and oyster farming can save the ocean through carbon capture and sequestration

Maine-based Running Tide uses carbon-capture and oyster farming techniques – using both low and high technology – to restore ocean health.