Results contribute valuable knowledge to viable aquaculture species

South Africa has marine and freshwater aquaculture using extensive (earth ponds, long lines and rafts) and intensive (recirculating systems, sea cages, flow-through pump, ashore systems) methods, and 11 species are cultured. The mariculture sector mostly produces finfish, molluscs, crustaceans and seaweed species in the coastal provinces of Western Cape, Eastern Cape, KwaZulu-Natal and Northern Cape. Finfish culture consists of dusky kob (Argyrosomus japonicus), silver kob (A. inodorus), yellowtail kingfish (Seriola lalandi). Mollusk production includes mainly native commercial species such as the South African abalone (Haliotis midae) and non-native species including the Pacific oyster (Crassostrea gigas) and Mediterranean mussel (Mytilus galloprovincialis). Seaweed (Ulva spp. and Gracilaria spp.) species are cultured and utilized as supplementary feed in abalone farming.

A few marine species are currently being studied as prospective aquaculture candidates. These species include but are not limited to spotted grunter (Pomadasys commersonnii), white stumpnose (Rhabdosargus globiceps), yellowbelly rockcod (Epinephelus marginatus), mangrove snapper (Lutjanus argentimaculatus), scallop (Pecten sulcicostatus), collector sea urchin (Tripneustes gratilla), sea cucumber (Holothuria scabra) and octopus (Octopus vulgaris). The South African mariculture sector also involves hobbyist and commercial production of various marine ornamental fish and plants.

Freshwater aquaculture species in South Africa include introduced species such as rainbow trout (Oncorynchus mykiss), brown trout (Salmo trutta), Mozambique and Nile tilapia (Oreochromis mossambicus and O. niloticus), common carp (Cyprinus carpio), marron crayfish (Cherax tenuimanus) and various ornamental species. Other native species cultured include redbreast tilapia (Coptodon rendalli) and African sharptooth catfish (Clarias gariepinus). These freshwater species represent the bulk of commercial production, widely farmed in the Provinces of Limpopo, Mpumalanga, KwaZulu-Natal, Western Cape, Gauteng, Free State and North-West.

The internal analysis (strengths and weaknesses) and external analysis (opportunities and threats) of key mariculture and freshwater aquaculture species in South Africa have been extensively reviewed and documented by the Department of Agriculture, Forestry and Fisheries (DAFF) using the traditional qualitative SWOT (strengths, weaknesses, opportunities and threats) analysis approach. But because of the limitations associated with qualitative SWOT analysis, our study used a novel methodology, which integrates SWOT analysis with the quantitative method of Multiple-Attribute Decision Making (MADM), resulting in a hybrid method called SWOT-MADM by Chang and Huang (2006).

This article – adapted and summarized from the original publication (Adeleke, B. et al. 2021. Quantitative SWOT analysis of key aquaculture species in South Africa. Aqua. Fish and Fisheries 2021:1-15) – quantitively assessed the internal and external SWOT factors of key aquaculture species of South Africa using the Quantified SWOT analytical method SWOT-MADM.

Study setup

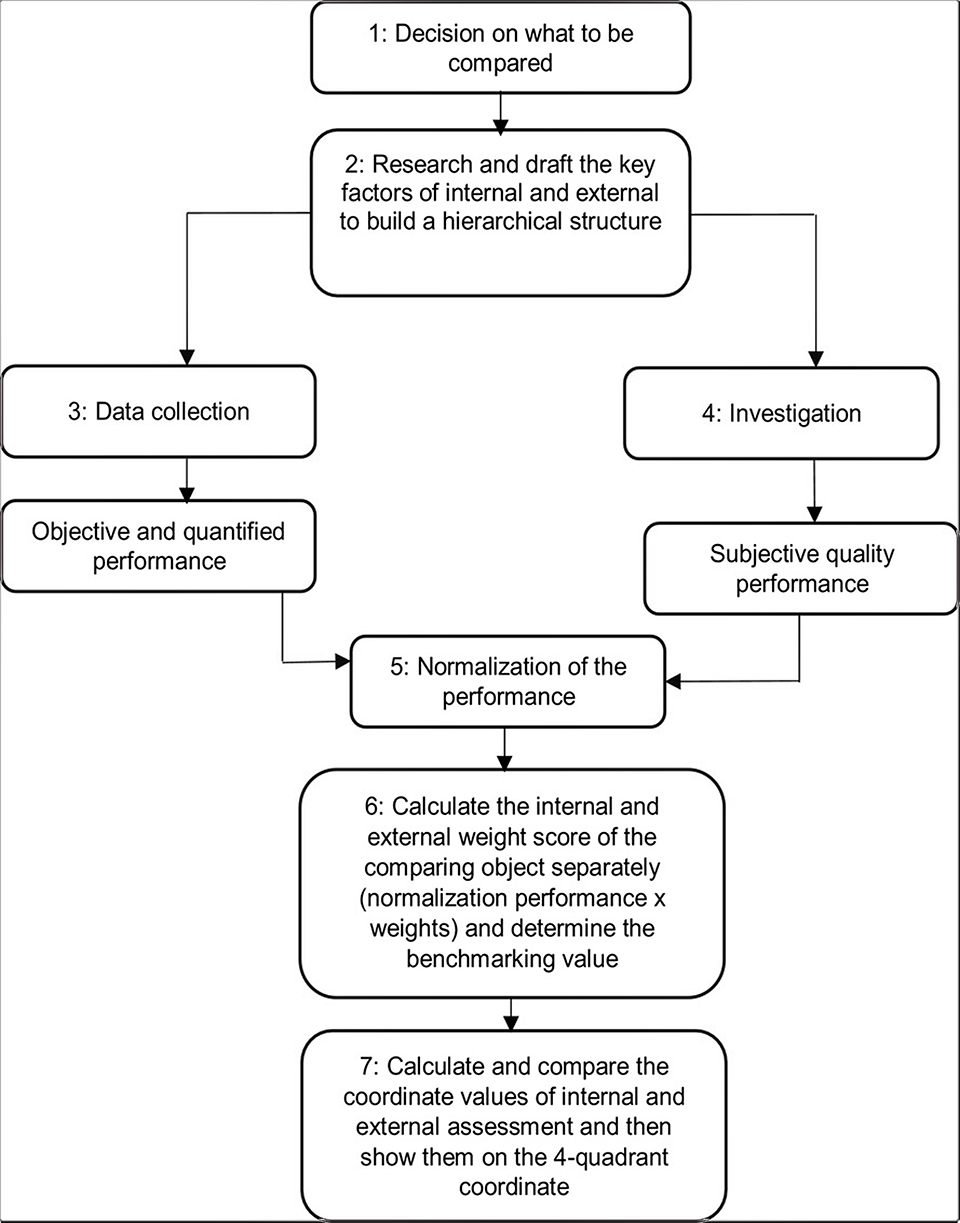

The quantified SWOT analysis was used to analyze defined internal and external factors of key aquaculture species in South Africa by combining SWOT analysis with multi-attribute decision making (SWOT-MADM) as described by Chang and Huang (2006) within a comprehensive analytical framework. For this study, the weights of the internal and external assessment factors were proposed to be equal. The approach for this study consists of the following steps (Fig. 1).

For detailed information on the methodology used; determination of assessment criteria; species information; data collection and normalization; benchmarking and SWOT coordinate values; and statistical analyses, refer to the original publication.

Results and discussion

Our study is a novel attempt at quantifying SWOT factors of major aquaculture species of South Africa to establish their aquaculture development and market potential. Our results are expected to contribute to the existing body of knowledge regarding viable aquaculture species in South Africa.

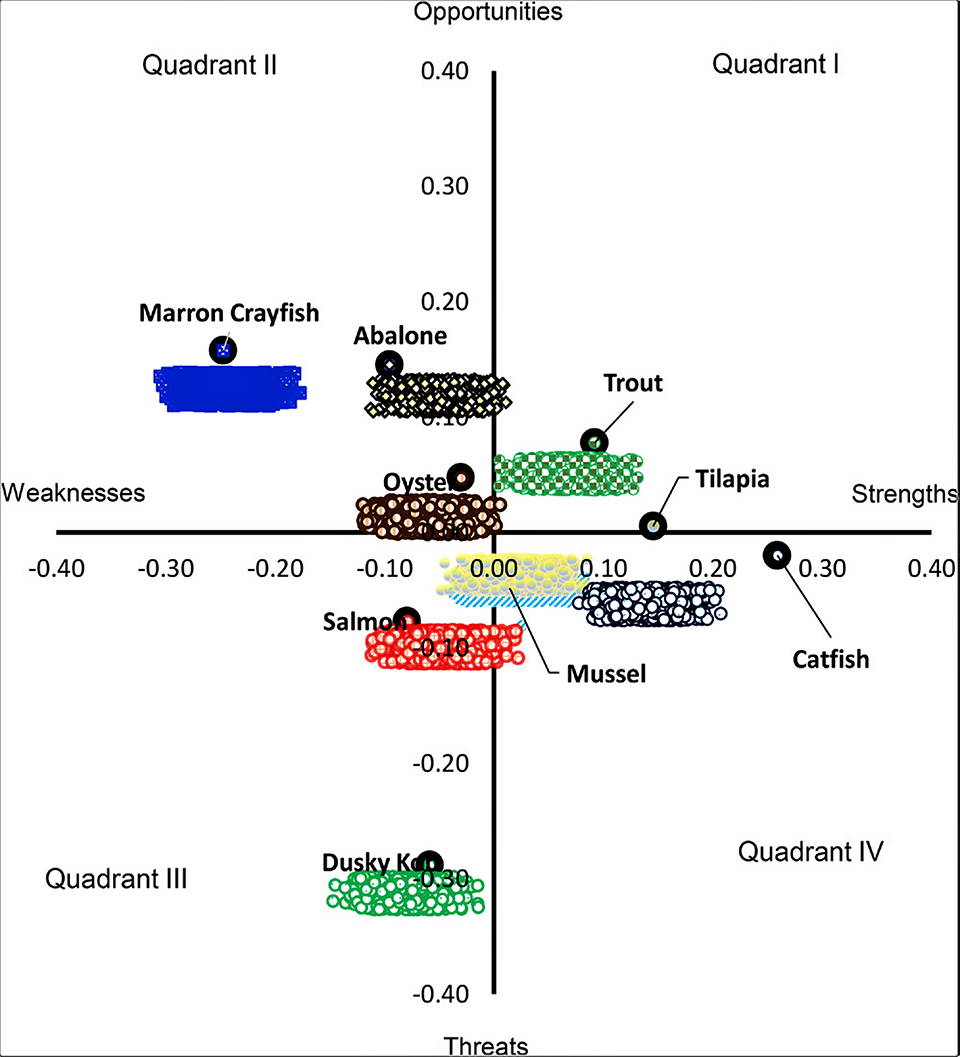

Trout and tilapia are the top-performing species based on their quantified competitive strengths, market opportunities and aquaculture development potentials. Dusky kob is the least performing aquaculture candidate due to its weak competitive strengths and several threats to its aquaculture development and market opportunities in South Africa. Although trout and tilapia are both situated in quadrant i, their levels of competitive strengths, aquaculture development and market opportunities are different (Fig. 2).

Tilapia showed higher competitive strengths compared to trout, due to internal assessment factors such as hardiness, the versatility of production technology, higher survival rate, environmental friendliness, ease of propagation in captivity and being capable of being cultured in different locations of the country. Tilapia species have some excellent levels of internal SWOT competitive strengths which under typical situations should favor higher production output in South Africa. But external SWOT factors (over-regulation, cost of production and market pricing) limit production and prevent achieving economies of scale.

The use of the widely permitted but slow-growing Mozambique tilapia instead of the faster-growing Nile tilapia in a capital-intensive operating system is also responsible for dismal production output and the inability to attain economies of scale. Nile tilapia is regarded as an alien invasive species (AIS) by the National Environmental Management Biodiversity Act (NEMBA). Therefore, obtaining the stringent AIS culture permit is often met with bureaucratic bottlenecks, even when the requirements are met, thus discouraging large-scale commercial investments. An enabling environment allowing the sustainable production of a better performing tilapia species is required in South Africa. A simplified and efficient process of obtaining AIS permit to culture Nile tilapia is expected to promote interest and investments in its production, leading to higher production and improved economic efficiency.

Trout has higher economic viability and market opportunities than tilapia due to external SWOT factors such as trade value, higher pricing, production output and various financial indicators. Trout is widely regarded as a high-value food fish in South Africa, with demand exceeding local supply. The competitive strengths of trout are mainly dependent on the internal SWOT factors such as better feed conversion ratio; ability to tolerate higher stocking density, and faster growth rate compared to tilapia. The major limiting internal SWOT factors for trout production in South Africa, however, are the limited availability and sub-optimal environmental conditions of suitable culture sites.

Trout production requires an all-year-round average water temperature of ∼18 degrees-C to attain optimal growth performance and viable yield, which are unattainable in most of the production sites, mainly due to higher water temperature (> 20 degrees-C) during the late summer months from January to March. These limiting SWOT factors are mostly responsible for the stagnant growth and development (< 2,000 tons/year) of trout production in South Africa.

For trout, the adoption of environmentally controlled production technologies such as RAS in a climate-controlled environment will be required to negate the effect of environmental suitability; however, this may significantly increase the cost of production. A 40:60 production cycle with 40 percent in RAS during summer and 60 percent in outdoor systems during winter in combined climate-controlled RAS and outdoor systems could potentially be a viable and efficient production model to boost South African trout production output. Assessing the economic feasibility of this combined production is required to determine it to be an alternative production model for trout production development in South Africa.

Abalone, oyster and marron crayfish are situated in quadrant ii (Fig. 2) and are not significantly different in weighted mean values of internal and external SWOT factors. These species have varying levels of economic opportunities but are currently weak in internal SWOT factor competitive strengths. Abalone and marron crayfish both possess higher levels of economic opportunities due to external SWOT factors such as high pricing and good financial indicators. But marron crayfish showed the lowest weighted value in with regards to competitive strengths compared to other aquaculture species. Internal SWOT assessment factors such as low stocking density, poor growth rate, lower survival rates, hardiness and limited geographic locations that are suitable for its culture are responsible for these competitive weaknesses compared to the other key aquaculture species.

South African abalone, though lower in the SWOT assessment compared with other species, has a higher external SWOT score due to the premium value, price and high demand from some Asian countries due to its cultural and reported medicinal values. It has the lowest growth rate compared to the other key species, as it takes up to 4 years to attain market size, but this is compensated by its outstanding economic performance as a major aquaculture foreign exchange earner species.

The major limitations of abalone’s external SWOT factors are high capital and operational costs which are compensated mainly with remarkable financial performance. The potential of strengthening the weak competitive position is highly limited due to the biological characteristics of abalone. However, the aquaculture development potential of abalone is primarily based on its market and economic returns. The abalone sector currently has the highest revenue compared to other key aquaculture sectors in South Africa, and capital investments are expected to translate to marginal growth in production output.

Marron crayfish has the lowest internal SWOT assessment weighted average value compared to the other species analyzed but ranks on par with abalone in reference to external SWOT assessment weighted average score. It has a lengthy production cycle of ∼24 months, slow growth, low survival, inability to withstand high stocking density and restricted production methods are all major challenges to achieve stable annual production. There is ongoing research to improve its growth performance and shorten its production cycle; as well as to assess alternative production systems. The species has economic opportunity on the SWOT matrix due to external SWOT factors such as demand-supply gap, high market pricing, lower capital and operating as well as excellent financial performance. But production is seen as limited until its hardiness, poor FCR and growth performance are properly addressed.

Oysters have a higher internal SWOT assessment weighted average score compared to abalone and marron crayfish mainly due to zero cost associated with feeding and ease of seedling production (spat) and supply but scored lower in external SWOT assessment weighted average. Oyster farming in South Africa is mainly dependent on spat importation of the hardier Pacific oyster species from Chile, Namibia and Guernsey, which are then supplied to grow-out farmers. The oyster sector has high market potential, especially with the rising demand for seafood on the international market, but various health and safety concerns need to be addressed.

Atlantic salmon is a high-value food fish with feasible production potential which offers the highest return on investment using scaled cage culture system. The potential for the viable cage culture system in South Africa is, however, mostly restricted to Gansbaai and Saldanha Bay in Western Cape due to the high energy coastline of South Africa. Aquaculture production has yet to achieve steady production due to a combination of internal SWOT factors (production technology and availability of suitable site) and external SWOT factor (economies of scale) unlike countries such as Scotland, Norway, New Zealand, Australia and Chile which have well-established production outputs. There are ample investment and market opportunities for the local production of Atlantic Salmon, due to steady growth in consumption which is wholly supplied by imports.

Dusky kob aquaculture in South Africa has the lowest external SWOT assessment weighted average score when compared with other aquaculture species, which impacted its market outlook. Currently, the domestic market size and opportunities for the species is small and limited due to external SWOT assessment factors such as low consumption, high capital and operating costs as well as low pricing. As a result of these external threats, coupled with the inability to attain economy of scale, commercial dusky kob aquaculture does not currently look like a financially feasible business case in South Africa.

Recent comparative trials of specially formulated feed on the growth performance of dusky kob and yellowtail kingfish could potentially be the breakthrough for the economic performance of finfish production and development in South Africa. Yellowtail production is currently still at a pilot-scale level in South Africa; however, its outstanding growth performance under intensive land-based culture system could potentially make it a better aquaculture alternative to dusky kob, with potential to drive aquaculture development.

African sharptooth catfish had the highest internal SWOT assessment factor weighted average score and had the strongest competitive strengths due lower feed conversion ratio; high stocking density; very rapid growth rate; high survival rate in culture systems; hardy and can be produced across the nation using suitable production technology. It is unclear what the current production data of catfish is in South Africa, due to lack of updated, official production information and data for several years, as most South African catfish producers do not report their farming data to the appropriate governmental departments for documentation purposes. This catfish species has much potential for increased aquaculture production in South Africa due to its strong competitive advantage over other aquaculture species, especially tilapia. Its market opportunities are, however, dependent on value-addition and consumption by the South African middle class.

Mediterranean mussels show higher competitive strengths than oysters, dusky kob, salmon, abalone and marron crayfish due to their internal SWOT assessment factors, including high production output, species hardiness and high survival rate, and simple and easy-to-operate grow-out technology. The major opportunity leverage for mussel production is lower capital and operational costs due to zero cost associated with grow-out feeding and seedstock, as well as a simple production technology. As a result of these cost benefits, mussel production in South Africa appears to be a financially viable business case.

Perspectives

The potential to rapidly grow aquaculture production output in South Africa is largely dependent on a combination of factors, including attainment of economies of scale, cost-effective adaptive culture technologies and provision of tailored enabling environments like incentives to reduce cost of operations, simple authorization procedures and nationwide promotion of fish-eating culture to drive growing local demand.

Trout and tilapia showed appreciable competitive strengths. Trout currently has the highest economic opportunities among the key finfish cultured in South Africa but is limited by suitable sites and optimal environmental conditions. A combined production method may potentially alleviate the challenges experienced with single production technology associated with trout production. The production of tilapia in aquaponic systems compared to RAS will increase the economic viability of tilapia production due to the additional revenue stream from integrated plant production.

Abalone has the most remarkable market opportunities due to good financial indicators, pricing and absence of imports, but it has marginal growth in production output as a result of weak competitive strengths, mainly due to poor FCR and growth performance.

Atlantic salmon and dusky kob were weak in competitive strengths and confronted with more threats than market development opportunities. Salmon, unlike dusky kob, has ample potential for market growth if challenges such as availability and access to a suitable production site, adaptable production technology and ability to attain economies of scale associated with steady production are adequately addressed. Preliminary findings on the growth performance and yield of yellowtail kingfish appear promising, and it may potentially replace dusky kob as a better performing aquaculture candidate if the commercial trials prove successful. Catfish and mussels showed a higher level of competitive strengths but are yet to achieve economic success.

This study is expected to guide aquaculture industry stakeholders and prospective producers to make informed decisions with regards to the feasibility of aquaculture species in South Africa and may also allow for improvements on the challenges facing the production of the species here analyzed.

Now that you've reached the end of the article ...

… please consider supporting GSA’s mission to advance responsible seafood practices through education, advocacy and third-party assurances. The Advocate aims to document the evolution of responsible seafood practices and share the expansive knowledge of our vast network of contributors.

By becoming a Global Seafood Alliance member, you’re ensuring that all of the pre-competitive work we do through member benefits, resources and events can continue. Individual membership costs just $50 a year.

Not a GSA member? Join us.

Authors

-

Babatunde Adeleke, Ph.D.

Corresponding author

Marine Biology, School of Life Sciences, University of KwaZulu-Natal, Durban, KwaZulu-Natal, South Africa[109,111,99,46,108,105,97,109,103,64,101,107,101,108,101,100,97,101,100,110,117,116]

-

Deborah Robertson-Andersson, Ph.D.

Marine Biology, School of Life Sciences, University of KwaZulu-Natal, Durban, KwaZulu-Natal, South Africa

-

Marine Biology, School of Life Sciences, University of KwaZulu-Natal, Durban, KwaZulu-Natal, South Africa

[46,68,46,104,80,32,44,121,101,108,100,111,111,77,32,115,97,110,97,71]

-

Simon Taylor, Ph.D.

Regional and Local Economic Development Initiative (RLEDI), Graduate School of Business and Leadership (GSB&L), University of KwaZulu-Natal, Durban, KwaZulu-Natal, South Africa

Tagged With

Related Posts

Responsibility

Aquaculture Exchange: Corey Peet

Shrimp farming expert Corey Peet discusses the work of convening multiple stakeholders in Southeast Asia, the role of certification and the dynamics of sustainability challenges confronting marketplace demands.

Innovation & Investment

Investing in Africa’s aquaculture future, part 1

What is the future that Africa wants? Views on how to grow aquaculture on the continent vary widely, but no one disputes the notion that food security, food safety, income generation and job creation all stand to benefit.

Innovation & Investment

Is Africa a ‘new Asia’ for aquaculture?

Now is the time for investment in efficiency improvements, better genetics, health management and more competition and innovation in the feed sector. Let's not perpetuate the myth that just a little more investment in some technical solutions will solve the problems in Africa.

Innovation & Investment

From South Africa, a cautionary tale for aquaculture investors

South Africa’s marine fish farming industry burned many investors, but the operational experiences aided productivity in intensive aquaculture systems, especially land-based RAS. The time to invest is now.