With U.S. land-based aquaculture development booming, new ventures exude confidence

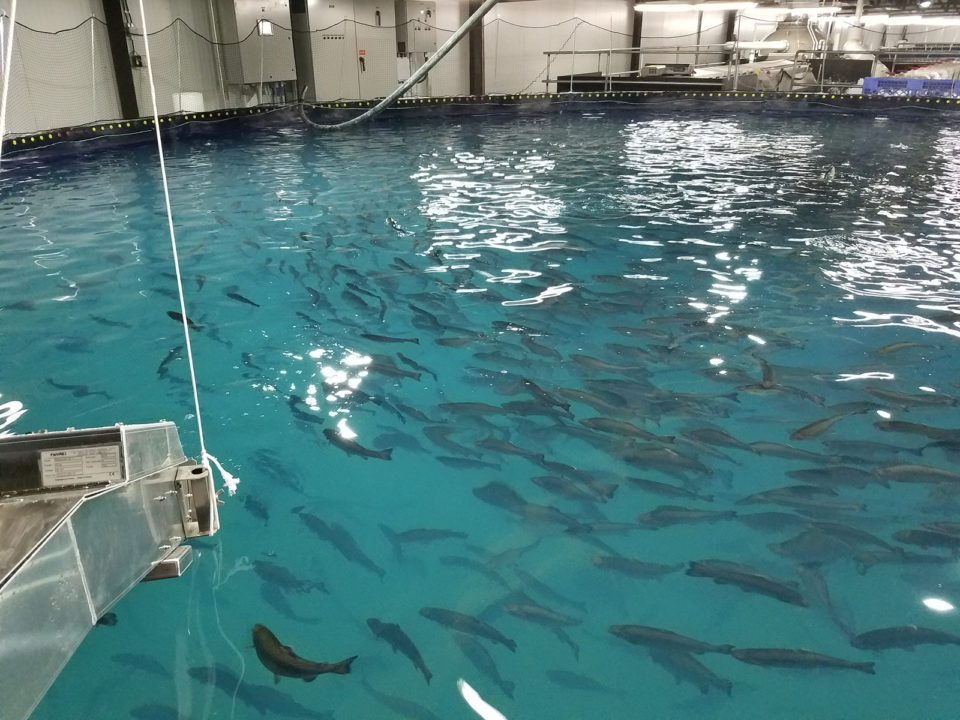

In a country known for celebrating those who make a quick buck, land-based Atlantic salmon farmers are instead taking the long view. A rash of large-scale, land-based salmon facilities are planting their flags on U.S. soil, even though it will take several years and hundreds of millions of dollars of investment before the most recently announced ventures produce their first sellable fish.

Growing demand for not just for Atlantic salmon but any foods that can be traced back to their chemical-, hormone- and antibiotic-free origins – not to mention advances in technology that are making the process cheaper and cleaner – have led to this kind of investment in time and money in the United States.

In the view of one operator that already has a few years of operating a land-based aquaculture facility, the move to terrestrial tanks is no passing fad.

“There’s a huge amount of money pouring into this sector,” said James MacKnight, director of sales and marketing at Ideal Fish, a Connecticut-based facility currently raising branzino. MacKnight welcomes the addition of new players to the field: “It’s obscene and wonderful. The time is now.”

Launched in 2013, Ideal Fish is a 63,000-square-foot facility that boasts it can get its fish from its tank to consumers’ plates in less than 24 hours. Having a 100 percent traceable path from start to finish is important to today’s consumers who want local food, and to know where the food came from, MacKnight said. Now, that process is sustainable on the business end too. “The technology is there today to give us the chance to be economically viable where before it wasn’t really there. I believe the technology is there. I believe that the market conditions are there.”

Clearly the barriers to entry for land-based salmon are coming down, and the barriers for growth for net or cage farm salmon are increasing.

Land-based recirculating aquaculture system (RAS) facilities are popping up everywhere from Miami to Wyoming. Maine will soon be home to two such outfits: Nordic Aquafarms, a company that already operates two land-based farms in Denmark and will be opening its first U.S. facility in Belfast, Maine, in 2020; and Whole Oceans, which plans to break ground in Bucksport, Maine, this year.

At its farms in Denmark, Nordic Aquafarms produces both salmon and yellowtail kingfish. In its U.S. facility, which is expected be operational by 2020, the company will produce only Atlantic salmon. When completed, it will be one of the largest-such facilities in the world, with more than 30,000 tons of annual production capacity.

An estimated $500 million investment is, obviously, large, but Nordic Aquafarms CEO Erik Heim said that “you need to be long term because your start of planning until you have your fish out the door – you’re easily looking at four years.”

He pointed to the price of Atlantic salmon shares on publicly traded companies on the Oslo Stock Exchange and said that “your investment per pound of fish is not necessarily any larger” than buying those shares.

Heim said that maturing technology and “know-how in relation to how this production can work” along with a growing demand for fish protein that “has not been growing at the pace it needs to be in the coming decades to meet future seafood demand locally” makes the investment in the Belfast facility sound.

“It’s an opportunity space there that’s interesting,” he said.

Samuel Chen, head of corporate business development at New York-based Hudson Valley Fish Farms, agrees.

“There is an impending protein shortage, and seafood is one of the most efficient ways to product protein,” he said. Chen’s business is currently raising steelhead, a type of Pacific salmon.

This shortage, combined with the fact that there “isn’t too much growth opportunity with wild fisheries,” said Chen, in addition to a drive for local seafood production because of consumer demand for traceability and lower costs (especially with a possible trade war and tariffs making international products more expensive) have left the door wide open for land-based farms.

“Forward-thinking companies are seeing the opportunity for greater control over quality and the ability to create a differentiated product,” he said, comparing it to the beginning of Wagyu for the cattle industry, where temperature, exercise rate, what the animal ate and harvesting methods were all under the producer’s control.

Whole Oceans plans to have its fish ready for sale from its Maine facility in the fall of 2021. The company has already pre-sold 100 percent of its production for the first 10 years.

“Clearly the barriers to entry for land-based salmon are coming down, and the barriers for growth for net or cage farm salmon are increasing,” said Ben Willauer, director of corporate development at Whole Oceans. “That infliction point, we believe, is happening as we speak, especially in areas where it’s very difficult to expand ocean-based work, such as in the United States, which has strict environmental rules.”

The Whole Oceans facility is being built along the Penobscot River in the former Verso paper mill site. The building already has the cooling infrastructure needed, said Willauer, plus the river is the right salinity and temperature for Atlantic salmon – and “is the home to wild Atlantic salmon at the heart of their historical spawning run,” he said. A three-hour drive to Boston, a large Atlantic salmon distribution point, made Bucksport location ideal spot, too.

https://www.aquaculturealliance.org/advocate/location-matters-most-newest-maine-ras-venture/

Land-based salmon farms are often met with apprehension from local communities who might initially associate them with problems found in other types of fish farming. They end up being more concerned about who the new jobs will go to, as Whole Oceans discovered during an informational meeting held in Bucksport in late March.

“We will be able to hire folks that have traditional trade skillsets like engineering and plumbing, as well as some specialty skillsets like chemistry, biology and fish veterinary health,” Willauer said, noting that Bucksport is also close to two large engineering schools. “We can hire someone with a high school diploma and give them an appropriate amount of workforce training, heavily assisted in cost by the state of Maine, and they would be eligible to work at our facility.”

“What you’re seeing in key sections of innovations are not just land based. The big push in Norway now is offshore production, which is further out to sea,” said Heim of Nordic Aquafarms. “I think you’re going to see innovation and development of all branches of aquaculture. Land-based is here to stay. It’s already a permanent part of the industry. It’s just about how far you take it in terms of fish and harvest.”

Follow the Advocate on Twitter @GAA_Advocate

Author

-

Jen A. Miller

Jen A. Miller is a Pennsylvania-based writer whose work has appeared in everything from The New York Times to Engineering News Record.

Tagged With

Related Posts

Intelligence

City fish-farm prototype set to prove itself in Minnesota

The Urban Organics model of farming leafy greens in conjunction with fish can work in any city environment, the company says. The first step is destroying East St. Paul’s image as a food desert.

Innovation & Investment

Competitiveness comes at scale for RAS operations

Total RAS salmon production worldwide is less than half of 1 percent of total production. Many of the investors flocking to the sector now are new to fish farming, and confident in its potential.

Innovation & Investment

Stormborn: The U.S. land-based shrimp farming industry

With farmed shrimp production having largely shifted overseas, RAS technologies offer potential solutions for growing production in the United States. The industry is poised for growth, thanks to entrepreneurs who believe in its potential.

Innovation & Investment

Developments in closed-containment technologies for salmonids, part 1

The recent 2017 Aquaculture Innovation Workshop in Vancouver brought together numerous stakeholders involved in and interested in fish farming – particularly salmonids – in the growing industry of closed-containment systems.