Despite pandemic challenges, outlook for 2022 is promising

With projections showing growth for the aquaculture industry, the future of feeding the world was discussed during the Global Seafood Alliance’s virtual GOAL Grand Finale on Nov.17.

Joined by industry leaders and data analysts, the 2021 Global Aquaculture Production Survey and Analysis was unveiled, featuring the results of this year’s exclusive aquaculture production survey for shrimp and finfish. With the UN Climate Change Conference (COP26) concluding this month, discussions also covered the role of aquaculture in combatting the climate crisis and the promise of growing the blue economy.

To view this GOAL session and all the other virtual events from 2021, please visit our conference platform.

‘Fantastically huge’ potential

Árni Mathiesen, senior advisor at the Iceland Ocean Cluster and former Assistant Director-General of the UN Food and Agriculture Organization’s Fisheries and Aquaculture Department, started the session by making the case for blue food growth within the context of COP26.

“Why do we need blue growth?” asked Mathiesen. “One of the big [reasons] is that we are not managing collectively to avert negative changes due to climate change. The growth of the supply of nutritious food will not be enough to feed the growing global population of the future.”

Taking a sector-by-sector approach, Mathiesen said that aquaculture can be part of the solution. With aquatic foods offering an excellent source of protein and fatty acids, as well as a lighter environmental footprint compared to land-based agriculture, he argued that the potential to increase production in the ocean is “fantastically huge.”

“We should be looking towards gaining [increased marine production] in our fight to stave off hunger and malnutrition in the world,” he said. “Right now, we are harvesting very little from the lower trophic levels in the ocean. We need to move down the food pyramid and put greater emphasis on the lower trophic levels.”

The lower trophic levels include harvesting everything from phytoplankton, microalgae and marine bacteria to mussels, clams and urchins. If harvested responsibly, Mathiesen stressed that aquatic foods can help “feed the world in the future” – a goal recently affirmed at the UN Food Systems Summit in New York City.

“We have opportunities, we have recognition [from the UN Food Systems Summit], and we should move forward to get more for the blue marine food system,” said Mathiesen.

Strong growth for global shrimp industry in 2021, ‘bullish outlook’ for 2022

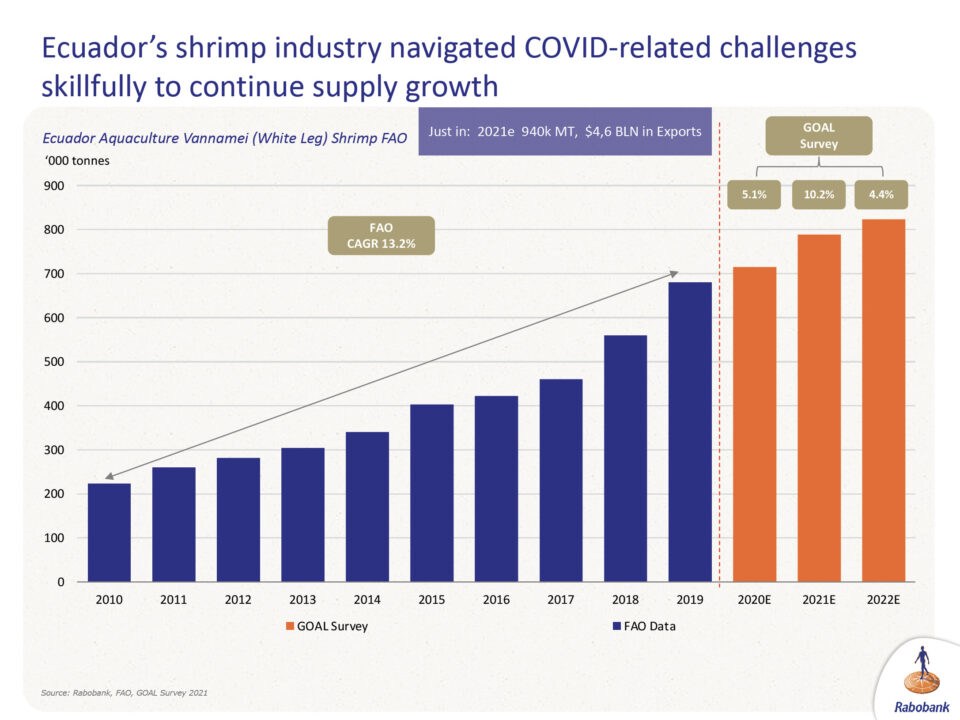

Gorjan Nikolik, senior analyst at Rabobank, presented the 2021 Global Aquaculture Production Survey and Forecast findings, starting with shrimp. A top takeaway was the “impressive performance” from Ecuador’s shrimp industry, which grew by more than 5 percent in 2020 and is projected to increase by 10 percent in 2021. Looking at both volume and value in 2021, Ecuador is slated to overtake India as the world’s top shrimp exporter.

“What we just heard a few days ago from sources is that Ecuador would actually break 940,000 metric tons in shrimp exports, with a whopping $4.6 billion in exports,” said Nikolik. “It has to do with Ecuador focusing more on the United States and Europe, where we demand a higher level of processing. They have increased their level of processing and their supply.”

Overall, the global shrimp industry experienced strong growth in 2021, with estimates indicating that global shrimp production levels increased by 8.9 percent. However, it’s anticipated that number could reach up to 10 percent or higher once end-of-year data from Ecuador and Brazil are incorporated into the analysis.

Looking ahead, there’s a “bullish outlook” on the horizon, with a projected 5 percent growth for 2022. Still, uncertainty lingers in the industry, with survey results indicating that a possible drop in market prices is the top concern for shrimp operators.

“There’s a lot of supply going but the strength of demand is not yet clear,” said Nikolik. “It’s been amazing so far, but how long will that maintain? Are we going to have more COVID outbreaks and more lockdowns?”

Salmon sector ‘very stable’

Data from the Global Finfish Aquaculture Production Survey and Forecast indicated that the two large salmon producers – Norway and Chile – experienced opposite supply dynamics in 2021.

“On the one side, you have Norway recording an incredible growth rate of 10 percent in 2021,” said Nikolik. “It’s based on, to a large extent, good biology.”

In contrast, Chile contracted in 2021, with total production levels projected to dip 14.1 percent below the previous year. However, the production is predicted to rebound by 8.8 percent in 2022.

Interestingly, Nikolik predicted that, based on the data, Iceland would become a major producer in the global salmon sector, and may reach similar levels as the Faroe Islands in the next five to six years: “When you put it all together, despite the volatility of Chile declining and Norway growing, the salmon industry looks like it’s a very stable sector, growing at 5 percent in 2020, 4 percent in 2021, and 5 percent in 2022.”

Other highlights included growth numbers indicating “an incredible rise” in Latin America’s tilapia industry, which is currently the fastest-growing tilapia region, driven by Brazil. Another “exciting new development” is Atlantic cod, which Nokolik identified as a sector to watch in the future.

“We saw an incredible growth in 2021 – the sector basically doubled from a small base,” he said. “The expectation is that it will grow by 50 percent next year.”

‘We need to move in the same direction’

With the attention to the COP26 conference and increasing public interest in climate change, corporate responsibility is a hot topic. A panel of industry leaders discussed the importance of setting corporate goals and aligning them to the United Nations’ Sustainable Development Goals (SDGs).

“It’s important to align goals and ambitions with larger purposes, like the UN SDGs, because it shows that you acknowledge that you’re a global citizen with responsibilities,” said panelist Vidar Gundersen, group sustainability director for BioMar, a leading aquafeed manufacturer based in Denmark. “The goals are an urgent call for action, and very soon, it is expected that all organizations address relevant SDGs. If not, they risk becoming discredited.”

However, achieving such goals can be a challenge. The panelists discussed the art of setting sustainable goals, offering guidance on everything from setting realistic organizational goals and targets to consulting external third parties to reporting frequency. Ultimately, the experts emphasized that, while all goals may not be reached each year, what’s important is to continually drive improvement.

“We have used the UN SDGs as a compass to assess the direction in which the world is moving,” said panelist Tordis Poulsen, group sustainability director for Bakkafrost, the leading producer of farmed salmon from the Faroe Islands. “We need to move in the same direction. The longer you drift off course, the more issues you get. Following the course is just the right thing to do.”

Follow the Advocate on Twitter @GSA_Advocate

Now that you've reached the end of the article ...

… please consider supporting GSA’s mission to advance responsible seafood practices through education, advocacy and third-party assurances. The Advocate aims to document the evolution of responsible seafood practices and share the expansive knowledge of our vast network of contributors.

By becoming a Global Seafood Alliance member, you’re ensuring that all of the pre-competitive work we do through member benefits, resources and events can continue. Individual membership costs just $50 a year.

Not a GSA member? Join us.

Author

-

Lisa Jackson

Associate Editor Lisa Jackson lives in Hamilton, Ontario, Canada. Her work has been featured in Al Jazeera News, The Globe & Mail, The Independent, and The Toronto Star.

Related Posts

Responsibility

GOAL 2021: Can green financing further sustainable seafood development?

The Global Seafood Alliance’s seventh virtual GOAL conference session delved into the role of green financing in fueling seafood’s transformation.

Responsibility

GOAL 2021: Climate change and the ‘dilemma’ of food systems

The latest virtual GOAL conference session dissected the role of seafood production systems and how they perform in a changing climate.

Aquafeeds

GOAL 2021: With animal feeds under scrutiny, aquaculture can make a strong claim

The true cost of aquafeed and feed ingredients goes beyond dollars, said presenters during GSA’s virtual GOAL session on animal feed production.

Responsibility

‘Do more and do better’ – Sustainability manager discusses Skretting’s ambitious agenda

Aquafeed giant Skretting recently appointed Jorge Diaz as its sustainability manager to advance its ambitious sustainability agenda.