As seafood sales stall due to inflation, retailers and their suppliers do what they do best – remain nimble and adjust to consumer needs

Inflation. Inflation. Inflation. The rising cost of goods and services is having damaging and perhaps lasting effects on retail seafood sales and consumption and was a popular topic of conversation at last week’s Seafood Expo North America (SENA).

Keynote speaker Megan Green, a global economist and senior fellow at the Watson Institute and public affairs at Brown University, placed inflation atop her Top 10 list of geopolitical and macroeconomic risks in 2023. The U.S. labor market is tight and is smaller than it was before the COVID-19 pandemic and the economy remains stuck in a wage-price spiral, she explained. What’s worse is the factors that have spearheaded other economic comebacks might not work in the United States’ favor again.

“As China booms, we’ve relied on them to pull us out of slumps. Not this time,” she said, adding that China’s rise having a negative impact on inflation was of “medium” probability. China’s consumer confidence, she said, can “turn on a dime.”

The same might not be true elsewhere, and evidence is mounting that inflation is hitting seafood on a more granular level as well. According to the U.S.-based FMI-Food Industry Association’s recently released Power of Seafood 2023 – the subject of a SENA conference session with the same name on March 12 – inflation was a leading factor in an almost 7 percent dip in the number of seafood units sold at retail from 2021 (2.9 billion units) to 2022 (2.7 billion units).

However, the number of seafood units sold at retail in 2022 were up almost 4 percent from 2019, reflecting the pandemic’s influence on consumers cooking fish at home. In dollars terms, retail seafood sales, while sluggish, remain higher than pre-pandemic levels, totaling U.S. $16.3 billion in 2022, up from $13 billion in 2019 but down from $16.9 billion in 2021 and $16.7 billion in 2020.

“Retail seafood [sales] grew by $3 billion. Now we’re down $400 million. Yeah, we’re falling off. But let’s not panic. [Post-pandemic] we’ve maintained a great deal of that volume [growth]. Sales are good,” said Guy Pizzuti, business development director-seafood for Publix Super Markets, which operates more than 1,350 stores in the southeastern United States.

Our customers are asking us to do more with value-added. That’s the change. How can you refresh your mindset?

“It was really fun to see the big increases. No other department had that kind of increase,” added Jason Pride, VP of meat and seafood for Hy-Vee, which operates more than 240 stores in the midwestern United States. But, he admitted, “We have to fight a little bit harder for what we get today.”

Inflation is eating into U.S. consumers’ disposable income, and as a result, many are buying seafood less frequently at retail (though the post-pandemic resurgence of foodservice is also a contributing factor). In fact, the percentage of consumers qualifying as occasional shoppers (less than two purchases per week) slipped from 30 percent in 2021 to 29 percent in 2022, while the percentage of consumers qualifying as frequent shoppers (two or more purchases per week), fell from 29 percent to 24 percent. At 47 percent, the percentage of shoppers who don’t buy seafood at all is at its highest in five years. There’s a clear shift from frequent shoppers to occasional shoppers, explained Steve Markenson, FMI’s VP of research and insights and a key contributor to the fifth annual report.

What’s more, price has overtaken quality and freshness as the top factor in determining where consumers primarily shop for seafood; price jumped from 47 percent in 2021 to 50 percent in 2022, while quality and freshness dropped from 48 percent in 2021 to 46 percent in 2022. The next three factors on the list were location of store (43 percent), customer service (35 percent) and variety of seafood offerings (33 percent).

In the conference session, Markenson played clips from interviews he conducted with dozens of consumers for the 55-page report. In addition to inflation, there’s an even more obvious factor impairing retail seafood sales and consumption – time, or lack thereof.

“Like the mom said, ‘Now I’m out of time.’ We’re back into this time-starved crunch,” said Pizzuti, referring to the comments of one of the consumers Markenson interviewed.

Inflation and time aside, moderator Rick Stein, FMI’s VP of fresh foods, and the three panelists – Pizzuti, Pride and Christine Ngo, executive VP of Los Angeles-based seafood supplier H&N Group – remain relatively upbeat about the future of retail seafood sales and consumption, which they attributed to the industry’s nimbleness and ability to adjust.

“We operate in chaos,” joked Pizzuti, referring to seafood’s ability to adjust during the pandemic. “We’re constantly chasing. Other proteins didn’t shift like seafood did.”

Special report: Retail demand reduces COVID-19 pain for seafood industry

The panelists concurred that to retain or grow seafood’s share of the grocery basket retailers and their suppliers need to focus on what’s selling well; provide more tray-pack seafood, value-added seafood and meal-kit solutions; and offer more deals and better communicate the value of seafood.

“Space is such as asset today,” commented Ngo. “Retail has reduced its SKUs. Retail is focused more on what’s selling well. I’ve seen a big [shift to] meal kits, grab and go. Our customers are asking us to do more with value-added. That’s the change. How can you refresh your mindset?”

With all the talk of inflation, some seafood species are a great value today, said Ngo, pointing to shrimp. “Shrimp is at its lowest [price],” she said. “But yet we are not advertising shrimp the way we advertise chicken. The message has to get better on that. There are some species that are getting better and better in terms of availability.”

The panelists also agreed that despite all the challenges stemming from inflation most retailers are not backing off the amount of store space dedicated to fish. For example, all 1,356 Publix stores have at least a 12-foot fresh seafood case.

“The research is pretty clear they want it,” said Pizzuti. “The challenge is proper variety, right sizing. We are committed to full service. We are not going to get rid of our fresh cases.”

Follow the Advocate on Twitter @GSA_Advocate

Now that you've reached the end of the article ...

… please consider supporting GSA’s mission to advance responsible seafood practices through education, advocacy and third-party assurances. The Advocate aims to document the evolution of responsible seafood practices and share the expansive knowledge of our vast network of contributors.

By becoming a Global Seafood Alliance member, you’re ensuring that all of the pre-competitive work we do through member benefits, resources and events can continue. Individual membership costs just $50 a year.

Not a GSA member? Join us.

Author

-

Steven Hedlund

Manager of Communications and Events

Global Seafood Alliance

Portsmouth, NH, USA[103,114,111,46,100,111,111,102,97,101,115,108,97,98,111,108,103,64,100,110,117,108,100,101,104,46,110,101,118,101,116,115]

Related Posts

Responsibility

‘They thought we were crazy’: Behind one Faroe Island salmon farmer’s bold stance to reduce its carbon emissions

Hiddenfjord executive’s insistence that “fish should never fly” flies in the face of industry norm. This Faroe Island salmon company intends to do things greener.

Health & Welfare

‘The right thing to do’: How aquaculture is innovating to reduce fish stress and improve animal welfare

With research showing that stress can damage meat quality, fish and shrimp farmers are weighing the latest animal welfare solutions.

Fisheries

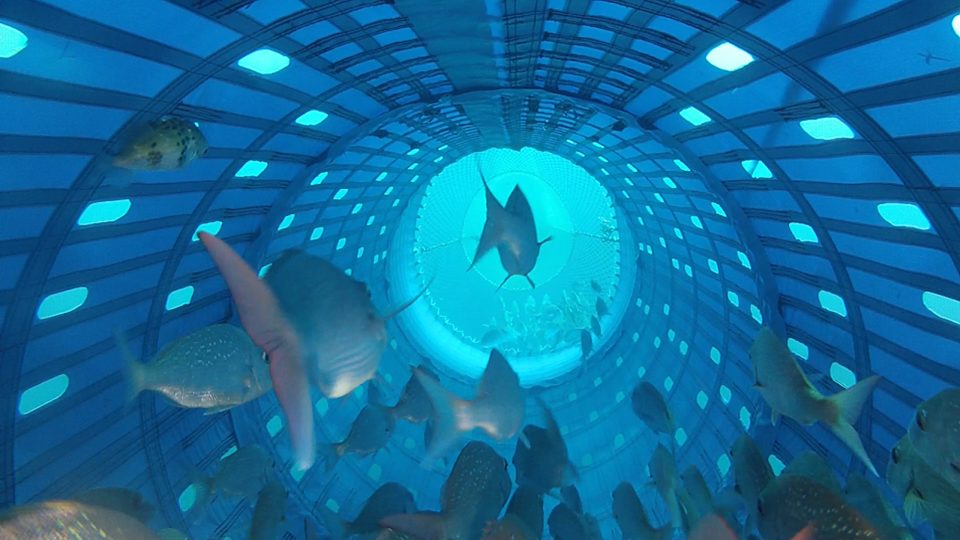

‘We were just looking for a way to fish better’: How one partnership is reinventing commercial fishing nets to reduce bycatch and improve animal welfare

Precision Seafood Harvesting’s novel reimagining of commercial fishing nets provides innovative solutions to both bycatch and animal welfare issues.

Responsibility

A wider view: Consensus on seafood’s planetary and human health benefits

Several recent reports echo the message that eating sustainable seafood can help save the planet while making significant gains in public health.