Global finfish production forecast covers species that will contribute at least 41 percent of the total aquaculture production (live weight, excluding algae) projected for 2023 and 2024

This article summarizes the annual Global Finfish Aquaculture Production Survey and Forecast report from the Global Seafood Alliance, jointly prepared with Gorjan Nikolik of Rabobank and

Ragnar Nystøyl of Kontali and presented at the recent Responsible Seafood Summit 2023 held in Saint John, New Brunswick, Canada. The survey targets relevant and representative fish species and groups based on their trade value and/or production volumes.

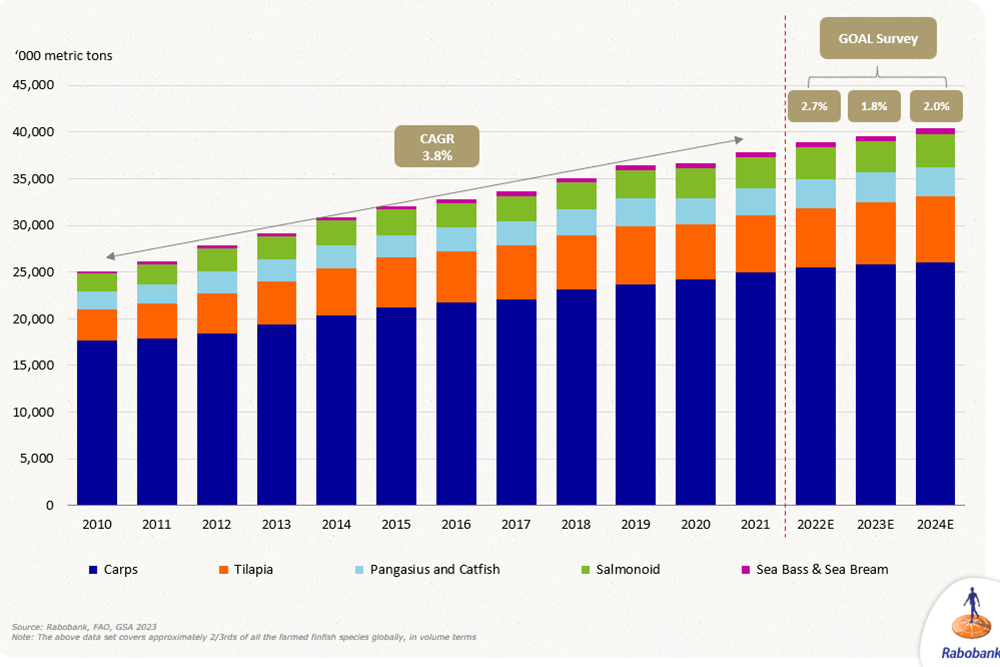

Global production of major farmed fish species

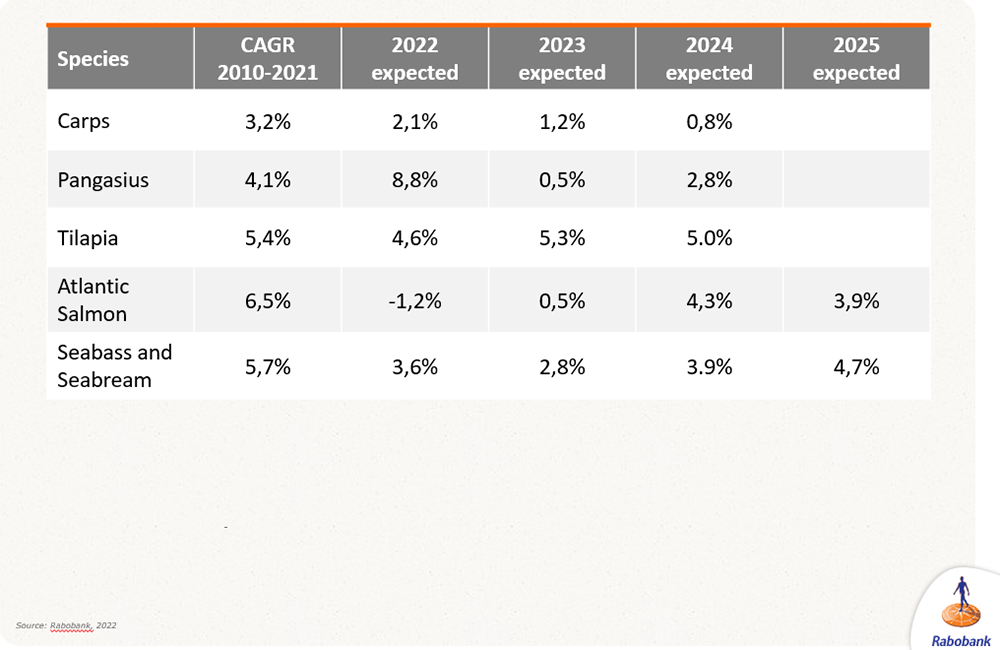

Survey results indicate that the world’s production of our major, representative five species/groups of finfish – carps, tilapias, pangasius and catfishes, salmonids, and sea bass and sea bream – in 2023 will likely be around 39.6 million metric tons (MMT), up about 1.8 percent from the 38.9 MMT reported in the 2022 survey. For 2024, production from these species/groups is projected to grow by 2 percent to around 40.4 MMT.

The GSA fish survey covers species that will contribute at least 41 percent (39.6 and 40.4 MMT) of the total aquaculture production (live weight, excluding algae) projected for 2023 and 2024, respectively, by the Food and Agriculture Organization of the United Nations (FAO).

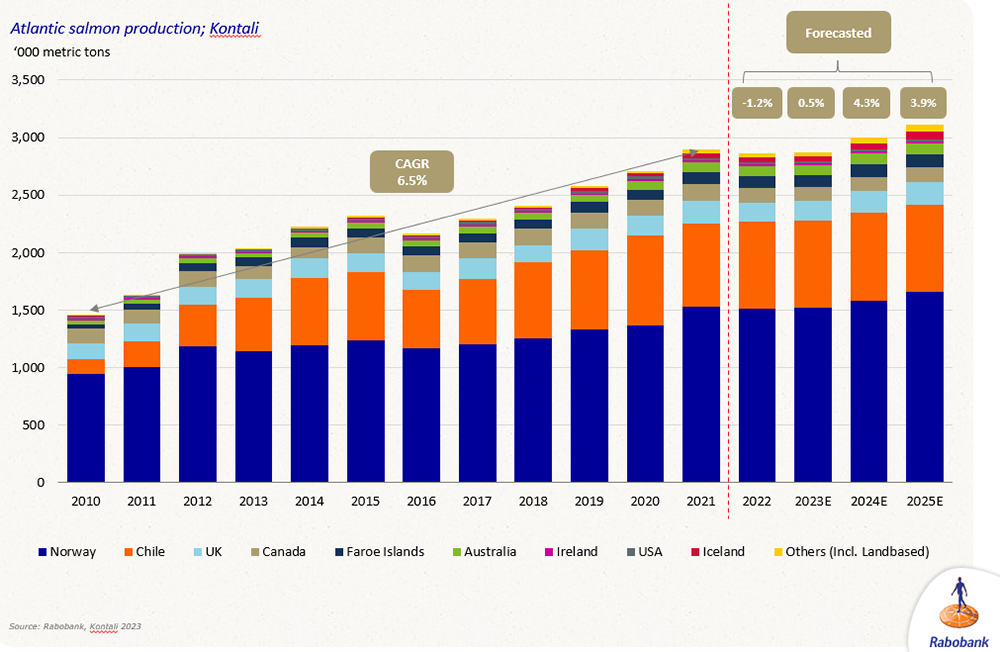

Salmonids

Data from Kontali indicates that global production of farmed Atlantic salmon, after being relatively flat in 2022 and 2023 at 2.86 and 2.87 MMT, respectively, could enjoy growth of 4.3 and 3.9 percent, respectively with potential production of 2.99 and 3.12 MMT in 2024 and 2025, respectively. Farmed salmon has outrun the wild-caught sector, not just in volume but also in value per unit. Some Asian markets have seen losses while the North American market has enjoyed strong growth to around 700,000 MT in 2022. Most producers of farmed Atlantic salmon are expecting higher production in 2023 and forward, led by Norway (1.52 MMT in 2022, 1.53 MMT in 2023, 1.58 MMT in 2024, and 1.66 MMT in 2025).

Coho salmon production, strongly led by Chile, for salmon years 2022/2023 is estimated at 234,600 MT, up to 296,500 MT in 2023/2024, and down to 239,200 MT in 2023/2025. Large rainbow trout production, grown in seawater to over 2 kg and led by Chile and Norway, continues to grow steadily, from 303,200 MT in 2022, to 301,500 MT in 2023, 313,000 MT in 2024 and 337,000 MT in 2025. Data for small rainbow trout production, grown in freshwater to less than 2 kg. led by Iran and Turkey, shows some decline with total 2022 production of 676,700 MT, 676,100 MT in 2023 and 668,000 MT in 2024.

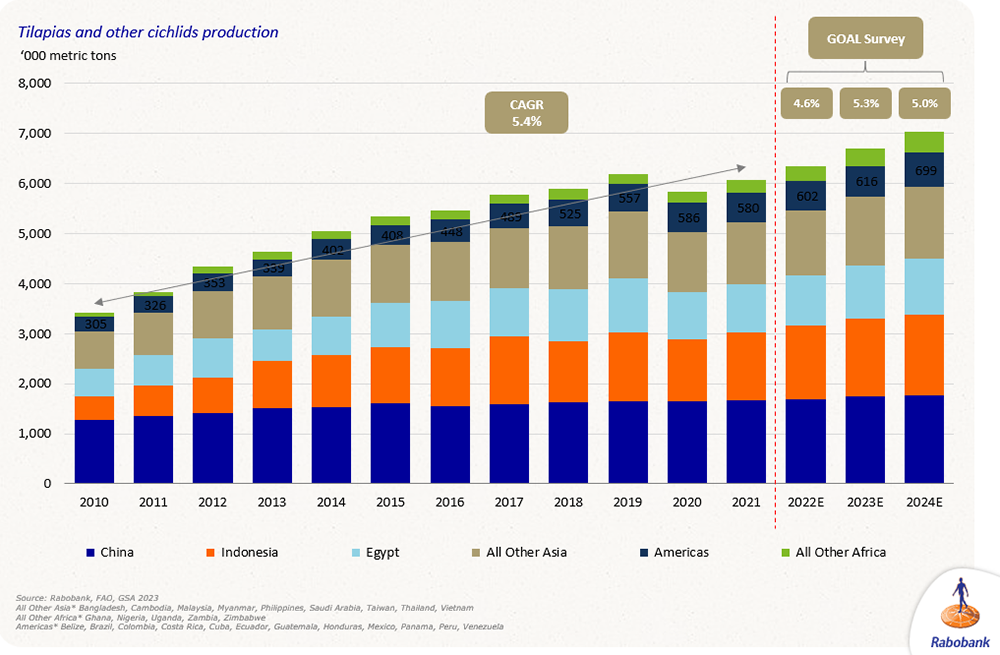

Tilapias

After a pause in 2020, global tilapia supply growth seems to have recovered and is expected to reach the 7 MMT mark in 2024. Global production of farmed tilapia in 2023 is projected at 6.7 MMT, up about 5 percent over 2022 levels, and 7.03 MMT in 2024, up another 5 percent from 2023 volumes.

The main producers of farmed tilapia are still China, Indonesia, Egypt and Brazil. The first two countries will produce each over 1.6 MMT in 2023e, with Egypt’s 2023 production estimated at over 1.1 MMT, In China, tilapia appears to be a mature sector with modest expansion; however, Indonesia is still on a rapid growth path with expected growth of 5 and 3.7 percent in 2023 and 2024, respectively. There are some strong growth volumes among other Asian tilapia producers, including Bangladesh, Philippines, Thailand, Vietnam and others. In Latin America, the top producer is Brazil with around 400,000 MT in 2023, followed by Colombia, Mexico and other countries.

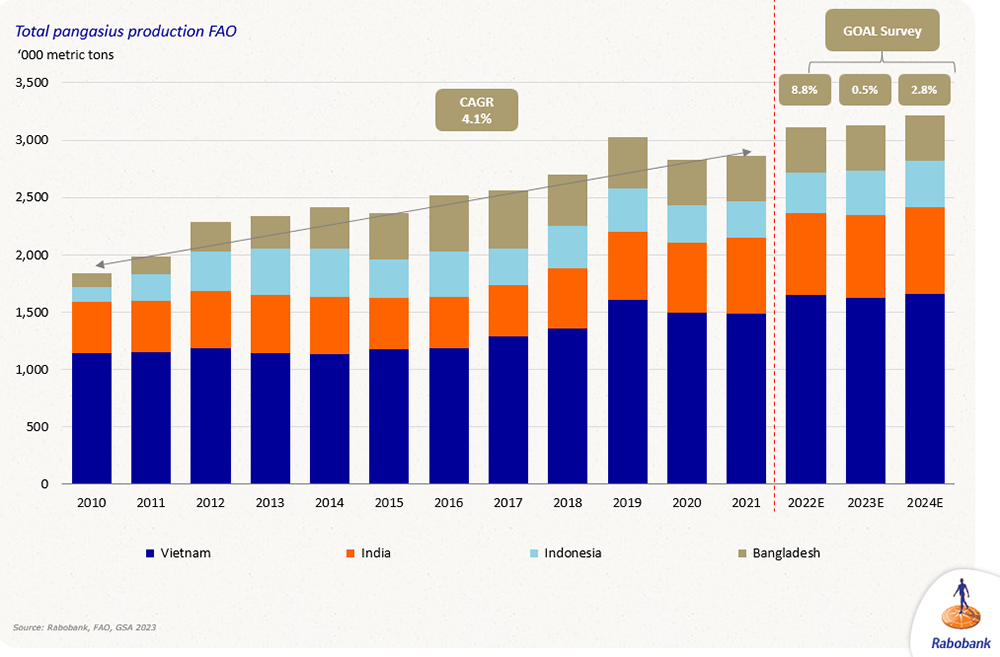

Pangasius

Pangasius supply is still to recover to the supply levels reached in 2019. Global supply is driven by Vietnam; now in gradual recovery mode, but still well below the supply of 2019. Production is estimated at 3.13 MMT in 2023 (up 0.5 percent from 2022 production of 3.11 MMT), led by Vietnam with 1.62 MMT, followed by India, Indonesia, Bangladesh and China.

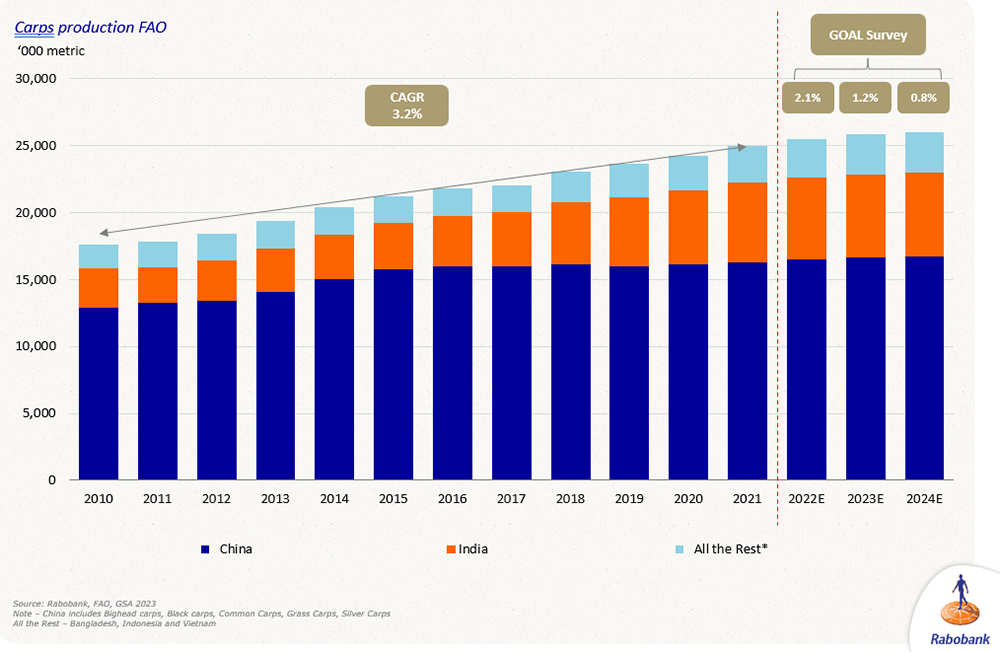

Carps

Carps as a group comprise – including Chinese (grass, silver, bighead, common and black carps) and Indian major carps (catla, rohu and mrigal) – the largest cluster of species in terms of volume produced, with very little international trade of these species but having a very significant nutritional impact for many millions of people.

Global production of all carps is estimated at over 25 MMT in 2023, with China producing at least 16.7 MMT, followed by India with at least 6.2 MMT, and several other countries comprising at least another 3 MMT. Production in 2023 grew an estimated 1.2 percent from 2022 and is projected to increase by 0.8 percent in 2024. In China, production of carps appears to be slowing down further to 1 percent growth per year, with other main carp producers, especially India, also slowing down their supply growth rate.

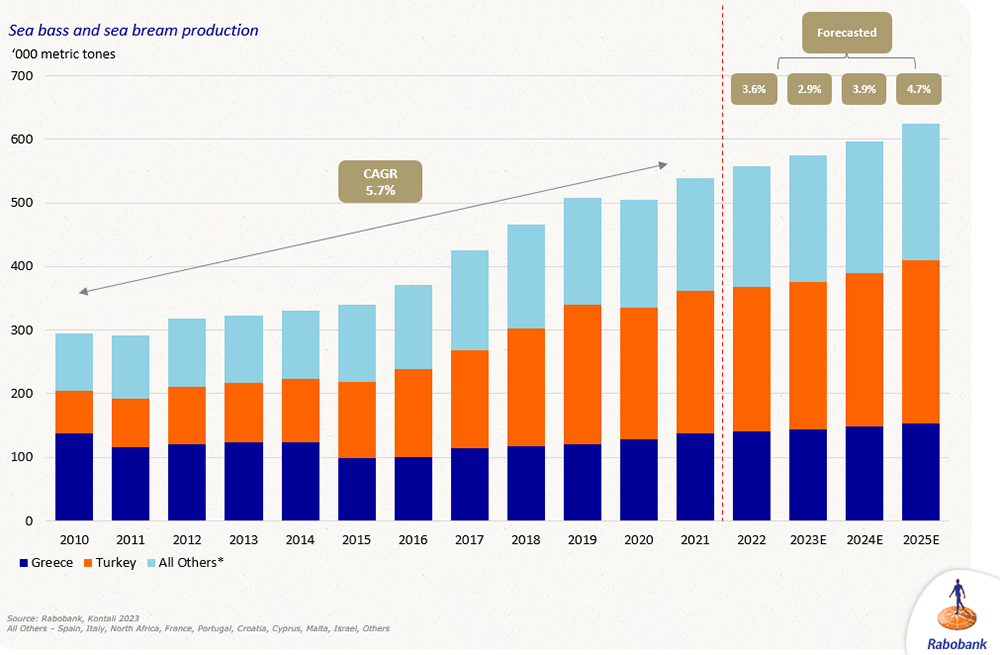

Sea bass and sea bream

These species are mostly grown in countries bordering the Mediterranean Sea, although there is some very limited production in other areas. Production of both species combined is projected to reach 596,550 MT in 2023, up 2.9 percent from 2022, and 624,550 in 2024 up 3.9 percent from 2023. Greece and Turkey are the main producers, and production is expected to have two strong years of growth in 2024 and 2025, driven in part by Turkey’s expansion. By 2025e, Croatia is likely to be the new No. 4 producer, overtaking Italy but well behind Spain.

Perspectives

Based on survey responses for the species/groups of finfish species tracked, a modest supply decline is predicted for 2023e with growth in 2024e projected at 0.8 to 5 percent for these fish species.

As for the shrimp survey results, there is significant potential to expand farmed finfish production globally – the technologies and know-how exist (a good example is the significant proliferation of land-based RAS systems, mostly for salmonids but also for other species) – and this should happen as the global economy continues recovering from the impacts of the recent pandemic.

Now that you've reached the end of the article ...

… please consider supporting GSA’s mission to advance responsible seafood practices through education, advocacy and third-party assurances. The Advocate aims to document the evolution of responsible seafood practices and share the expansive knowledge of our vast network of contributors.

By becoming a Global Seafood Alliance member, you’re ensuring that all of the pre-competitive work we do through member benefits, resources and events can continue. Individual membership costs just $50 a year.

Not a GSA member? Join us.

Author

-

Darryl Jory, Ph.D.

Editor Emeritus

[103,114,111,46,100,111,111,102,97,101,115,108,97,98,111,108,103,64,121,114,111,106,46,108,121,114,114,97,100]

Tagged With

Related Posts

Responsibility

GOAL 2021: Growth ahead for the aquaculture industry

Discussion at the final GOAL 2021 event ranged from Ecuador’s booming shrimp sector to the ‘compass’ of the UN’s Sustainable Development Goals.

Innovation & Investment

Aquaculture is winning, Rabobank analyst explains

Aquaculture is the “winning protein,” according to a new Rabobank report that its author, Gorjan Nikolik, said is intended to draw the bank’s agro-industry clients to opportunities in the fish farming business.

Aquafeeds

Aquaculture Exchange: Giovanni Turchini, Deakin University, part 1

One of the world’s leading fish nutrition experts talks about how aquaculture can learn to survive, and even thrive without depending on fishmeal and fish oil. It’ll take a lot of innovation, but Giovanni Turchini is confident that the industry is on the right path.

Innovation & Investment

Developments in closed-containment technologies for salmonids, part 1

The recent 2017 Aquaculture Innovation Workshop in Vancouver brought together numerous stakeholders involved in and interested in fish farming – particularly salmonids – in the growing industry of closed-containment systems.