Unaffected areas – Ecuador, Indonesia, India, Bangladesh and Myanmar – are rapidly expanding production

The decade-long boom of the shrimp aquaculture industry has been halted by the outbreak of early mortality syndrome (EMS). By impacting the three largest producers – China, Thailand and Vietnam – EMS is responsible for the industry’s largest-ever contraction in supply and subsequent record prices. Nonetheless, this is an opportunity for second-tier shrimp-producing regions such as Ecuador, Indonesia and India to step up production and capture market share.

With the recent discovery of the cause of EMS, there is hope the disease will be under control in the short to medium term. Against that backdrop, Rabobank International expects the current period of record high prices will be followed by a large supply rebound and adjustment in shrimp prices. It also expects the industry to emerge more consolidated, with larger, diversified and more vertically integrated multinational producers leading the next growth wave.

EMS halts growth in supply

Shrimp aquaculture is one of the world’s youngest protein industries. In the last decade, nearly all key producing regions in Asia switched to the high-yielding and more disease-resistant Pacific white shrimp (Litopenaeus vannamei) replacing the black tiger shrimp (Penaeus monodon) and other species. Today, vannamei account for close to 75 percent of global production, while monodon account for only 15 percent. This change came with several technological advances, including improved hatchery technology, genetics, feeds and husbandry techniques.

Combined with booming demand for this healthy premium protein, the result has been a trebling of global farmed shrimp output in less than a decade and the creation of one of the largest aquaculture industries in the world – surpassing farmed salmon, the key Western aquaculture species, in both volume and value. However, as is common for any young, rapidly growing protein industry, operational risks remain high.

Historically, periods of high production have culminated in below-cost price levels, which in turn have been interrupted by natural disasters such as droughts, floods and, most importantly, disease outbreaks, affecting production in entire regions. With white spot syndrome, which decimated the sector in the late 1990s, still fresh in the minds of many producers, an outbreak of early mortality syndrome is the most recent challenge the industry needs to overcome.

EMS creates winners, losers

After reaching nearly 4 million metric tons (MT) in 2011, the global shrimp supply contracted for the first time in more than a decade in 2012, followed by another contraction in 2013. So far, EMS has impacted Chinese, Thai, Vietnamese and Malaysian farms, creating double-digit yearly contraction in supply. Expectations are that Thailand – the world’s leading shrimp exporter, which supplies approximately 30 percent of the tropical shrimp markets of the United States and European Union – will see a decline in supply of as much as 50 percent in 2013.

On the other hand, regions unaffected by EMS are benefiting from the current high price situation. Producers in Ecuador, Indonesia, India, Bangladesh and Myanmar are rapidly expanding production. Indonesia’s growth is partly based on its own recovery from a white spot syndrome outbreak in 2009. Bangladesh and India are two of the latest, large procuring regions to start switching to the more productive vannamei shrimp.

The Indian subcontinent has an untapped shrimp-farming potential, and as industry expands along India’s eastern coast, the country has the potential to increase shrimp production many times. Myanmar, with the Irrawady Delta (almost as big as the Mekong) and the coastal belt of the Rakhine state, also has tremendous potential to greatly increase shrimp production.

Rabobank is hopeful that EMS, even if not eradicated completely, will at least be effectively controlled in the near term – possibly during 2014 – allowing supply to rebound. However, as the shrimp industry is still evolving and adapting new technology in a persistent search for ways to increase yield and grow production, it may not take long before another disease outbreak becomes the new challenge.

Lower risk in Latin America?

The farmed shrimp industry has two distinguishable business models: the lower-intensity farming model used in Latin America and the higher-intensity Asian model, with the latter contributing over 80 percent of global production. Currently, Asian production is led by regionally active vertical integrators that are often also involved in feed production and shrimp processing, with the shrimp farming part of the value chain outsourced to small, typically family-owned farming enterprises. Although this business model is capital efficient and allows for rapid growth, this structure has some key disadvantages from a biosecurity point of view.

Latin American producers operate at lower stocking densities – 15-50 postlarvae/square meter versus the 50-150 postlarvae/square meter typically stocked in Asia. In Asia, increasing intensity of production has been a method to deal with rising costs. However, this comes at the cost of biological risk.

It could be argued that although Latin American producers operate a less technologically advanced business model, when compared to Thailand, the risk of disease appears to be considerably less.

Multiple cost drivers

EMS, like other causes of mass mortality, is a key cost driver, but it is not the only one. Partly masked by disease outbreaks, the adoption of vannamei and other technological changes, the costs of key inputs have gradually increased. Energy costs, which are particularly significant with more-intensive farming systems, have increased in line with crude oil costs. Labor costs, an important element for the more-processed shrimp products, are also rapidly increasing.

Asian countries dominate the export of processed products. Particularly in China and Thailand, the two leaders in the export of processed shrimp products, wages have increased the most, averaging annual growth of 10 to 14 percent in the last decade. This, combined with the devaluation of the U.S. dollar, the euro or the British pound versus the currencies of leading shrimp-exporting nations means that all locally incurred production costs are increasing. Tariff and non-tariff trade barriers, such as administrative costs, are also increasing for exporters, especially toward the key import markets of the European Union and United States.

Feeds, which represent about 50 percent of shrimp production costs, have always been an important focus of cost control efforts by shrimp farmers and feed producers. The ability of vannamei to accept lower marine protein inclusion in feed relative to monodon has reduced the price of feeds. Moreover, vannamei have far better feed conversion than the larger monodon species.

Despite falling shrimp prices and rising commodity prices, for the most part, the shrimp-farming industry remained profitable for the last 10 years. However, by 2011, most key producers switched to vannamei, putting an end to this source of efficiency gains. Consequently, the recent sharp and simultaneous rise in the price of the essential commodities used in shrimp feed, such as soy meal and fishmeal, have made rapidly rising feed costs unavoidable.

Perspectives

The rise of production in India, Bangladesh and other secondary producers is likely not enough to prevent possibly the most acute shrimp shortage since the emergence of the shrimp aquaculture industry. This development coincides with a stagnating demand in key markets such as the E.U. and U.S., creating losses for shrimp importers and processors, and potentially triggering a wave of consolidation.

A recovery from EMS can likely be expected in the short to medium term. If there is no spread of the disease, a recovery could come as early as 2014. However, further spreading of the disease could significantly prolong the recovery period. In any case, when a recovery in supply does occur, expect a sharp increase in production. Consequently, the current high price conditions will likely shift downward.

The current environment will accelerate consolidiation in the sector, both among peers and vertically. Expect intercontinental mergers among producers and importers in Western markets to create global companies that will lead the growth and development of the shrimp industry.

Editor’s Note: This article is a summary of Rabobank Industry Note #396, August 2013.

EMS research seeks solutions

Acute hepatopancreatic necrosis syndrome (AHPNS), also known as early mortality syndrome (EMS), is the key reason for the contraction of shrimp supply in the last two years. Initially detected in southern China in 2009, EMS spread to Vietnam in 2010, Malaysia in 2011 and reached Thailand by 2012. It causes mass mortalities during the first 30 days after stocking both black tiger and Pacific white shrimp.

Recently a research group from the University of Arizona discovered that EMS is caused by a bacterial strain that colonizes the gastrointestinal tract of the shrimp. The strain itself is infected by a phage, which produces a toxin that disrupts the shrimp digestive systems. Frozen shrimp cannot transmit the disease because freezing kills the pathogen. Further research has shown that water with high pH can trigger the disease, and cannibalism of the infected shrimp is the key method of transmission. Smaller densities, tightening biosecurity measures, low pH levels and possibly stocking larger shrimp may help limit the impacts of EMS.

It is difficult to predict how long it will take the shrimp supply to recover from EMS. If, as with other major shrimp diseases, EMS spreads further, the supply of shrimp could be impacted for a prolonged period.

(Editor’s Note: This article was originally published in the September/October 2013 print edition of the Global Aquaculture Advocate.)

Now that you've reached the end of the article ...

… please consider supporting GSA’s mission to advance responsible seafood practices through education, advocacy and third-party assurances. The Advocate aims to document the evolution of responsible seafood practices and share the expansive knowledge of our vast network of contributors.

By becoming a Global Seafood Alliance member, you’re ensuring that all of the pre-competitive work we do through member benefits, resources and events can continue. Individual membership costs just $50 a year.

Not a GSA member? Join us.

Author

-

Gorjan Nikolik

Rabobank International

Croeselaan 18

3521 C.B. Utrecht, The Netherlands[109,111,99,46,107,110,97,98,111,98,97,114,64,107,105,108,111,107,105,110,46,110,97,106,114,111,103]

Tagged With

Related Posts

Health & Welfare

A holistic management approach to EMS

Early Mortality Syndrome has devastated farmed shrimp in Asia and Latin America. With better understanding of the pathogen and the development and improvement of novel strategies, shrimp farmers are now able to better manage the disease.

Responsibility

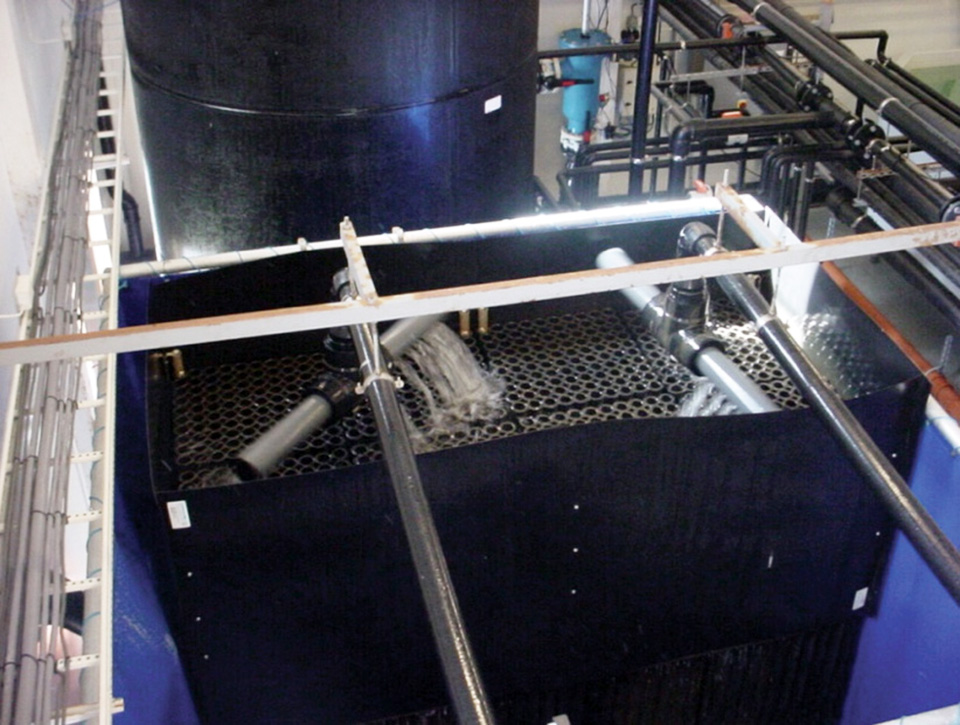

A look at unit processes in RAS systems

The ability to maintain adequate oxygen levels can be a limiting factor in carrying capacities for RAS. The amount of oxygen required is largely dictated by the feed rate and length of time waste solids remain within the systems.

Responsibility

A look at various intensive shrimp farming systems in Asia

The impact of diseases led some Asian shrimp farming countries to develop biofloc and recirculation aquaculture system (RAS) production technologies. Treating incoming water for culture operations and wastewater treatment are biosecurity measures for disease prevention and control.

Innovation & Investment

A review of unit processes in RAS systems

Since un-ionized ammonia-nitrogen and nitrite-nitrogen are toxic to most finfish, controlling their concentrations in culture tanks is a primary objective in the design of recirculating aquaculture systems.