Day two of the 2025 Responsible Seafood Summit explored how data, innovation and shared leadership can shape the future of global seafood

The morning’s first session turned that message into action, spotlighting fishery improvement projects (FIPs) as models for how partnership, data and persistence can drive lasting change. In a recorded interview, Federico Angeleri, head of Grupo Veraz, reflected on the long road to MSC certification for Argentina’s red shrimp fishery, which entered a formal FIP in 2015 and achieved certification in 2024.

“To be honest, in the beginning, we were moving really slow,” he said. “Why? Because one of the initial challenges was how to commit stakeholders to work on the plan – that was the most difficult part, in my opinion.”

Angeleri said the process required explaining and teaching crews why changes were needed and ensuring everyone, from captains to company leaders, understood the goal.

“We had a lot of discarded shrimp in the fisheries,” he said, citing this as an example. “We had to explain to the crew why we need to change these habits. But we made it.”

Angeleri’s advice to others starting down the same path: “Go ahead. Don’t be afraid. But when you start, it’s important that you commit the right people and that every stakeholder is committed to the process. Make a map of the responsible people – that’s very important.”

The discussion then turned to mahimahi fisheries, with David Parreno Duque of the Sustainable Fisheries Partnership (SFP) describing how FIPs are driving progress across the eastern Pacific. Mahimahi, he noted, has seen rapid growth in the U.S. market – a major shift for a fishery that historically lacked a strong export base. That growth presents an opportunity, he said, but also underscores the need for stronger management and better data collection.

“Mahimahi presents a strategic opportunity for sustainable development due to its biological resilience and its critical role in food security and in coastal livelihoods and economies,” said Parreno Duque.

Seven of the eight active mahimahi FIPs worldwide are now in Latin America – a concentration that reflects the eastern Pacific’s growing importance as a global production hub. Ecuador and Peru dominate output, followed by Panama, Guatemala and Costa Rica at smaller scales.

Across the region, FIPs are helping close data gaps through participatory monitoring and training programs. More than 700 fishers have been trained in Ecuador on data collection and the handling of protected species, while in Peru, a new fisheries management rule requires at least one trained crew member per vessel in sea turtle release techniques.

“Certification is not necessarily the final outcome,” said Parreno Duque. “Some will remain FIPs forever, because fisheries can’t [always] afford to be certified for different reasons.”

Successful collaboration also depends on leadership. Santiago Álvarez of Alfa Gamma Group said direct involvement from companies is essential to keeping the momentum.

“As a vertically integrated fishing company, we see this as existential,” he said. “Sustainability has to be managed correctly. It’s easy for us to make sure our vessels, processing facilities and headquarters are aligned, but SFP and the roundtables provide a great opportunity to bring more people across the industry on board.”

Álvarez said pre-competitive roundtables can help advance the fishery and unite competitors around shared goals. “Rising tides lift all boats – we need that message at all levels of the fishery.”

Salmon’s comeback year puts finfish back in the spotlight

After several years of stagnation, global salmon production is roaring back, driven by a short-lived but considerable boost in Atlantic salmon supply from Norway and Chile.

“In Norway, we had four bad years of low to negative growth,” said Gorjan Nikolik, senior global seafood analyst at Rabobank. “And suddenly, 11 percent growth [in 2025].”

The turnaround, he said, stems from a mix of good weather, effective vaccination programs and improved fish health that helped reverse disease-driven losses. Chile is seeing a similar rebound, up about 8 percent this year after a 9 percent decline in 2024. Meanwhile, the Faroe Islands are emerging as a salmon powerhouse.

“The Faroe Islands are the new number four,” said Nikolik. “After an incredible performance of 11 percent in 2024, we’re seeing another 25 percent growth this year.”

Iceland is also speedily recovering after a few rough years with sea lice, with 21 percent growth in 2025 and a projected 31 percent increase next year. “This is one of the most exciting Atlantic salmon regions,” said Nikolik.

Putting it all together, it’s a return to strong growth for Atlantic salmon after three weak years, with global production up nearly 9 percent. But Nikolik cautioned that it’s unlikely to last: “After this year, there’s an expected plateau of about 2 percent growth for the next two years.”

Beyond salmon, the broader finfish picture remains upbeat. In the Mediterranean, sea bass and sea bream production have resumed their familiar rhythm: Turkey expanding supply, Greece holding flat and second-tier producers like Spain, Italy and Croatia driving the next wave of growth.

Tilapia, meanwhile, continues its steady march, maintaining growth around its long-term trend. China’s sector has matured, growing by up to 2 percent this year, while Indonesia remains on a rapid path.

“Indonesia is doing really well, growing 6 percent last year and 4 percent in 2025,” said Nikolik.

Latin America, he added, is a “vibrant” tilapia region, led by Brazil and followed by Colombia. In Africa, Egypt still dominates the continent’s tilapia output, but emerging producers like Zambia, Ghana and Kenya stand out as “booming regions.”

“Egypt absolutely dwarfed the rest of Africa, so it’s difficult to notice [other reporting countries],” said Nikolik. “You might not see the success here, but the figures show 24 percent last year and double digits this year. I believe this may be the fastest-growing aquaculture region in the world.”

Carp remains the quiet giant of finfish aquaculture, representing roughly one-third of global production and could soon outpace salmon in total growth next year.

“In terms of supply growth, 2025 is firmly the year of Atlantic salmon, [but] for 2026, carps should take that crown,” said Nikolik.

Global finfish markets find their footing after years of turbulence

After several volatile years, the global salmon sector appears to be stabilizing, said Ragnar Nystøyl, managing director at Kontali, during his presentation on market dynamics. He described 2025 as a “catch-up year” for salmon, with roughly 9 percent global growth fueled by strong feed sales and improved fish health following several difficult production cycles.

“We are indeed in a shifting period,” said Nystøyl. “We come from some months with really strong supply growth back to a more limited supply growth situation once again.”

Looking ahead, Kontali projects global salmon harvests will grow 2 to 3 percent in 2026, but not evenly across producing regions. Chile is expected to be the main driver of volume gains, while Norway’s output is projected to dip mid-year before rebounding in the fourth quarter.

Angel Rubio and Joshua Bickert of Expana Markets outlined key trends across three major wild-capture species: pollock, salmon and mahimahi. Their analysis showed how shifting supply, regional production patterns and species cycles are reshaping global trade and pricing.

Alaska pollock remains the backbone of wild-capture supply – the world’s largest single-species fishery and second largest overall, accounting for about 3 percent of global catch. Production has held near 3.5 million MT, with the U.S. steady at 1.3 to 1.5 million MT and Russia expanding after years of recovery.

Russian production and expansion into Europe, Japan and the U.S. are pushing prices down. Surimi output has surged from 20,000 to 80,000 MT in two years, and Russian fillets are gaining ground in the EU market.

“The story is Russia versus the U.S. once again,” said Rubio. “The U.S. sends a lot of this pollock to Europe, but the Russians are also getting into that.”

Wild salmon is rebounding after a weak 2024, driven by stronger pink and sockeye runs, while mahimahi stood out for the wrong reasons: the lowest catches since at least 2007 and record-high prices.

“We’ve never seen this low catch ever, and normally that causes demand destruction later,” Rubio said. “But those prices have come down to incentivize buying.”

Tariffs create ‘disruptive chaos’ across global seafood trade

On a panel moderated by Melanie Siggs, seafood executives Bill DiMento of High Liner Foods and Travis Larkin of Seafood Exchange detailed how U.S. tariffs continue to create major uncertainty for importers and suppliers. Both described a highly unpredictable environment with ripple effects across nearly every fishery.

DiMento characterized the current climate as “disruptive chaos,” noting that while “the tariffs are not as disruptive as the Ukraine war has been,” they continue to affect almost every supply chain.

Larkin said companies are struggling to manage constant volatility: “What’s been difficult has been how frequently things have changed and the unpredictability. If you’re working in multiple countries of origin, it’s just pandemonium.”

He added that the full impact may not yet be felt, as many importers are still fulfilling year-end contracts.

“We’re playing a game of chicken with the American consumer,” Larkin said. “One day, someone’s going to come in and say that ‘This product was $7.99 and now it’s $11.99 – I can’t afford that.’”

‘We need a common language’: Rethinking sustainability metrics in aquaculture

After a morning of trade and tariff talk, the conversation pivoted to how the industry measures its impact, and whether those metrics truly reflect sustainability performance.

Dr. Brett Glencross, Technical Director of IFFO – The Marine Ingredients Organisation, took a critical look at the “alphabet soup” of sustainability metrics used to assess aquaculture feeds. Measures like the fish-in:fish-out ratio (FIFO) and forage-fish dependency ratio (FFDR), he said, “do not actually distinguish between well or poorly managed fisheries” and overlook the upgrade in value when low-cost fish like anchoveta (about $300 a ton) are turned into ingredients for higher-value farmed species like salmon (around $8,000 a ton).

He emphasized that small pelagic fisheries, including anchoveta, sardine and herring, are among the best managed and most sustainable globally. Contrary to long-held assumptions, “aquaculture growth doesn’t mean increased fish capture,” he said.

Moreover, Glencross argued that reducing fishmeal or fish oil use “will not mean less fisheries extraction” and that replacing them with alternatives doesn’t automatically make feeds more sustainable. The problem, he explained, is that “simplistic metrics do not allow for any assessment of trade-offs.”

Modern aquaculture feeds, he noted, are now mostly grain-based, while marine ingredients have become high-value strategic resources increasingly derived from byproducts.

“All food production systems produce waste,” he said. “It matters how we repurpose it.”

He urged the seafood sector to move beyond “simplistic assessments” and adopt universal frameworks like Life Cycle Assessment (LCA) to evaluate sustainability across the full value chain.

“Everything has a footprint,” he said.

Picking up that thread, Wesley Malcorps, CEO of Blue Food Performance, explored how strategic metric selection can help turn those footprints into actionable insights. He described aquafeed as an “environmental hotspot” and argued that feed performance should be assessed not only on resource dependency but also on efficiency, context and impact. FFDR, he noted, is “about dependency on a resource, not how much we use of that raw material.”

Malcorps highlighted the growing importance of species-specific yields, byproduct inclusion in fishmeal and fish oil and the need to align marine ingredient assessments with terrestrial and novel ingredients. In discussing actionable metrics and insights, he emphasized that “how you present the data matters,” warning against creating “a number factory.”

“We need a common blue food performance language, where we use the same data and metrics,” he said.

Stephen Gunther, director of sales and customer success at Wittaya Aqua, shared how digital tools can connect ingredient sourcing, feed formulation and on-farm management to better measure sustainability performance. As aquaculture works to meet ambitious ESG goals, he said attention too often stops at ingredient sourcing, when the real impact happens “beyond the bag.”

Gunther explained how their data-driven comparison and simulation tools can predict feed use, growth and emissions across production cycles. By modeling these interactions, producers can understand how feed management decisions translate into environmental and economic outcomes.

“You can use the most sustainable ingredients,” he said. “But how you manage that feed determines the impact.”

The feed frontier: From forests to fish

The focus on feed continued with sessions examining how ingredient choices shape both environmental impact and market resilience. Eve Nelson, Senior Consultant at 3Keel, discussed how aquaculture’s reliance on land-based ingredients has shifted sustainability focus to soy production. She highlighted the industry’s work on deforestation- and conversion-free sourcing and the importance of mapping and analyzing soy supply chains.

Jorge Torres, Business Development Director at Veramaris, addressed aquaculture’s ongoing EPA and DHA supply gap. Feed ingredient volatility, he said, poses serious financial risk, and “closing the gap can only be done by using alternative sources.”

Torres pointed to algae oil as one way to build up a reliable omega-3 supply “without taking more fish from the sea.” Reducing dependence on wild-caught fish, he added, boosts resilience and feed performance.

He also cited three “NGO influencers” – WWF, The Nature Conservancy and Earthworm Foundation – that are promoting collaboration across the value chain to reduce the need for wild-caught fish as a source of omega-3s.

“Collaboration is key,” Torres said.

Beyond net zero: WWF’s next chapter for sustainable seafood

In a keynote, Sergio Nates, Senior Director of Aquaculture at the World Wildlife Fund (WWF), laid out what’s next for the NGO’s work in seafood. WWF’s “next chapter,” he said, will focus heavily on feed ingredients – tracing their origins, land-use impacts and carbon footprints.

“Not all ingredients are created equal,” Nates said. “Over the next five to ten years, we will be looking at this more closely.”

He pointed to the Global Salmon Initiative as proof that progress is possible, with half of global production now certified and a goal to cut greenhouse-gas emissions by 50 percent by 2030. Still, uphill battles persist: agriculture consumes about 70 percent of the world’s freshwater, and roughly 8 million metric tons of plastic enter the ocean each year.

Outlining WWF’s position on carbon finance, Nates said companies should first cut emissions within their own supply chains before looking outward. WWF continues to champion nature-based solutions that restore ecosystems while benefiting people and the planet, and is urging governments to scale up climate finance through new market mechanisms such as carbon credits and Article 6 of the Paris Agreement.

Beyond policy, Nates highlighted WWF’s expanding portfolio of technology, collaboration and research driving measurable change: from AI habitat mapping and blockchain traceability to more than 90 seafood partnerships worldwide. He also pointed to Harnessing the Waters, WWF’s joint report with the World Bank, which describes what he called a “trillion-dollar opportunity” for sustainable aquaculture built on investment, inclusion and smarter resource use.

Marketplace matters: Responsible sourcing amid shifting supply chains

The morning wrapped up with a discussion with leading retailers and foodservice executives about responsible sourcing challenges associated with seafood products.

Sevrine Bethy, Global Food Safety and Responsibility Lead at Sodexo, said that as a foodservice and facility management company operating in 45 countries, being at the end of the supply chain means their decisions “impact health and well-being, social equity, the environment and marine biodiversity.” In 2010, Sodexo brought together cafeteria managers from across its global operations to share challenges and opportunities of working with the seafood industry.

“We ended up creating our seafood sourcing guide, designed by and for the cafeteria managers,” Bethy said. “One of the key outputs they shared with us was, ‘We want to sell the story and source fish and seafood for the next century.’”

She described the guide as a tool that shapes supplier partnerships and menu design, featuring underutilized species.

“The backbone of the sourcing guide is traceability and transparency,” she added. “We are working closely with our suppliers to ensure that the products sourced are fully traceable.”

For Red Lobster, consistency in wild-caught supply remains a challenge. Matthew Livesay, Executive Vice President and Chief Supply Chain Officer, said resource shifts and stock declines – like this year’s mahimahi shortage – demand agility.

“We added [mahimahi] to our finfish portfolio this year, and ultimately, it was the year that the resource went down significantly,” he said. “That’s a great example of how you just have to continue to be nimble.”

At Walmart, Michael Berto highlighted work in Ecuador with suppliers such as Santa Priscila, focusing on deforestation-free sourcing, renewable energy and mangrove regeneration. With backing from certification programs like BAP, Berto said, “When we have the right partners and the right volume, we can help change industries.”

Bethy added that certification is no longer a differentiator – consumers now expect it. Sodexo, she said, plays an active role in educating consumers and sharing “the great things our suppliers and experts are doing” to maintain trust in seafood.

Livesay closed on a note of pragmatism: “Science and technology are evolving so quickly,” he said. “Going forward, being more proactive in forecasting […] and doing post-planning analysis [to learn] from what didn’t go as planned and how to mitigate those risks.”

Afternoon explores sourcing, markets and accountability

Afternoon breakout sessions explored some of the seafood industry’s most pressing issues: from changing consumer behavior and market transparency to responsible sourcing and sustainability in aquaculture and fisheries. Panels examined global seafood trends, including how data can help businesses understand today’s consumer and adapt to shifting dietary preferences.

Other sessions dug into ingredient sourcing and the growing importance of certifications, while another focused on the realities and opportunities for small-scale fishers and farmers, especially in the Caribbean Sea.

A two-hour workshop hosted by Best Seafood Practices took a deeper dive into responsible wild-capture seafood sourcing, social accountability and chain-of-custody systems that strengthen trust in certified products.

GSA also honored Jeff Regnart as the latest recipient of the Wallace R. Stevens Lifetime Achievement Award. Regnart’s decades-long dedication to sustainable fisheries and his leadership in helping GSA evolve from its aquaculture roots into a broader seafood-focused organization have left a legacy on the industry. Read more here.

Now that you've reached the end of the article ...

… please consider supporting GSA’s mission to advance responsible seafood practices through education, advocacy and third-party assurances. The Advocate aims to document the evolution of responsible seafood practices and share the expansive knowledge of our vast network of contributors.

By becoming a Global Seafood Alliance member, you’re ensuring that all of the pre-competitive work we do through member benefits, resources and events can continue. Individual membership costs just $50 a year.

Not a GSA member? Join us.

Author

-

Lisa Jackson

Lisa Jackson is a writer based in Hamilton, Canada, who covers a range of food, finance, and environmental issues. Her work has been featured in Al Jazeera News, The Globe & Mail and The Toronto Star.

Tagged With

Related Posts

Innovation & Investment

FAU’s Queen Conch Lab and ISSF’s Jelly-FAD win the 2025 Responsible Seafood Innovation Awards

FAU’s Queen Conch Lab and ISSF’s jelly-FAD win top honors at the Responsible Seafood Summit, advancing sustainable aquaculture and fisheries.

Innovation & Investment

Responsible Seafood Innovation Award finalist: How FAU’s mobile hatcheries could save the Caribbean queen conch – one trailer at a time

FAU’s mobile hatcheries help restore queen conch, protect Caribbean ecosystems and support local communities through sustainable aquaculture.

Health & Welfare

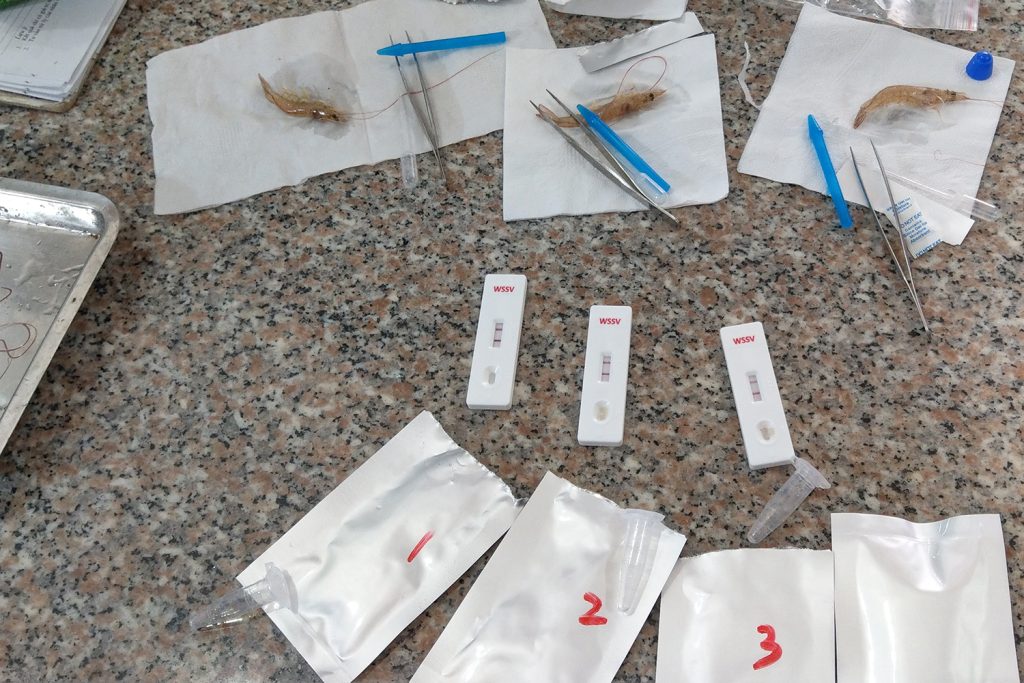

Responsible Aquaculture Innovation Award Finalist: Can InnoCreate Bioscience completely reform pondside white spot syndrome virus detection on shrimp farms?

InnoCreate pioneers the first rapid test for white spot syndrome virus (WSSV), giving shrimp farmers fast, affordable on-site detection.

Aquafeeds

Responsible Seafood Innovation Awards: Blue Food Performance wants the industry to speak the same language on fish-in:fish-out metrics

Blue Food Performance’s FIFO Performance Tool standardizes fish-in:fish-out metrics to strengthen aquaculture, improve transparency and counter misinformation.