Rapid development of a new industry

The tilapia-farming industry in Ecuador has developed rapidly, both as a consequence of and to mitigate the impact of the major Taura Syndrome Virus and White Spot Syndrome Virus epidemics experienced in the last decade. Compatible existing infrastructure and support industries (ponds, feed manufacturing, processing, seafood export) were instrumental in this development.

Ecuador currently has around 5,000 ha of tilapia ponds distributed among several companies. Most of these operations are farms that have either incorporated tilapia in polyculture, or totally replaced shrimp.

Polyculture with shrimp

Polyculture with shrimp offers a significant contribution to the biomass productivity per unit area of ponds. At an average salinity of 17 ppt and a stocking density of 0.2 fish per square meter, farms have increased the gross profitability of each production unit by over U.S. $6 per day, in 120-day cycles.

The El Rosario Shrimp Farm is stocking approximately 700 ha with tilapia, and an additional 500 ha will be stocked at the beginning of next year to reach a goal of over 9,000 MT, according to company president Jaime Faggioni. Tilapia production numbers are attractive, and other shrimp farms are also designating specific areas for tilapia monoculture.

Key elements

Ecuador provides an excellent example of the integration of tilapia into shrimp production. Vertical integration of the major Ecuadorian producers is definitely a key factor in the success the industry is experiencing.

Existing ponds

Ponds built for shrimp farming are being converted into smaller production units, so they can be managed more efficiently during polyculture cycles.

Water supply

The water supply used in most polyculture farms in Ecuador has not varied a great deal from the traditional monoculture days. Water is still delivered from tidal creeks, rivers, and estuaries through pumping stations directly into ponds. Farm managers have therefore not incurred much additional expense to provide the water required for polyculture production.

Feed industry

Perhaps the only major investment for existing Ecuadorian companies that decided to include tilapia among their crops has been in the technology to produce feeds suitable for tilapia consumption. El Rosario Shrimp Farm, for example, has built a new extrusion plant for the production of high-quality feeds. Extruded pellets float, which allows better feed management, and the extrusion process makes the nutrients more digestible.

Processing and packing

Most of the established Ecuadorian processing and packing plants that sell their products abroad, particularly to the United States market, have implemented international food-hygiene standards. By implementing HACCP and Codex Alimentarius guidelines, they facilitate product entry and acceptance in different export markets.

Ecuadorian tilapia products

Tilapia products include fresh whole (gutted), whole frozen (gutted), and fresh and frozen fillets (skinless).

Frozen whole

Exports of frozen whole tilapia (round fish, 300-500 grams) began in 1995. The most important markets are the U.S., Colombia and United Kingdom (Table 1). Whole prices rose sharply between 1995 and 2000, from U.S. $1.46 to $4.98 per kilogram.

Alceste, Export markets for the Ecuadorian tilapia products, Table 1

| Product | United States | Colombia | United Kingdom | Others |

|---|---|---|---|---|

| Fresh Fillets | 99.7% | – | – | 0.3% |

| Frozen Fillets | N/A | N/A | N/A | N/A |

| Whole Fresh/Frozen | 35% | 34% | 30% | 1% |

Frozen fillets

Ecuador exports what is known as “standard high-quality” frozen fillets. These are processed from fish that have been grown in favorable conditions and/or purged in clean water before harvesting. They are well trimmed, sorted into 57-86 grams, 86-143 grams, and 143- to 200-gram grades, and blast frozen or individually quick frozen.

Sales of frozen fillets in the U.S. (Table 2) and European markets are growing quickly, as consumers become more familiar with this product. In 1994, frozen fillets sold for U.S. $6.10 per kilogram, but dropped in 1998 to $3.44 per kilogram. In 2000, prices recovered to an average selling price of $4.99 per kilogram.

Alceste, Evolution of prices for tilapia products, Table 2

| U.S. $/kg | 1993 | 1994 | 1995 | 1996 | 1997 | 1998 | 1999 | 2000 |

|---|---|---|---|---|---|---|---|---|

| Fresh Fillets | 3.30 | 3.55 | 4.79 | 5.63 | 4.67 | 3.89 | 5.14 | 6.71 |

| Frozen Fillets | – | 6.10 | 4.40 | 4.55 | 4.89 | 3.44 | 4.84 | 4.99 |

| Whole Fresh/Frozen | – | – | 1.46 | 1.53 | 1.26 | 2.90 | 3.61 | 4.98 |

Fresh fillets

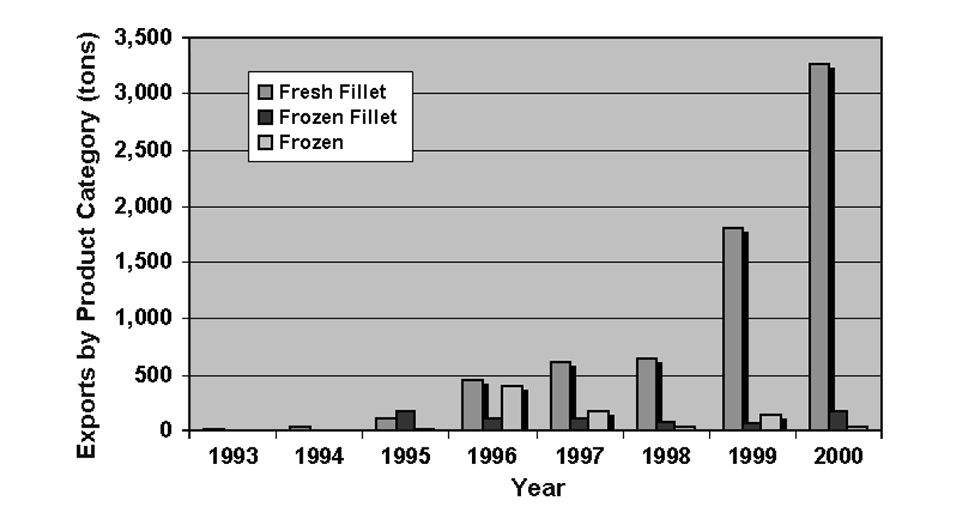

About 91 percent of the total production of tilapia is processed as high-quality fresh fillets of 114-171 grams (Fig. 1). Almost all production is exported to the U.S. Fresh fillets typically command higher prices than frozen fillets, although in recent years (except 2000), the price difference has narrowed. Fresh fillets are a more perishable product than frozen fillets, and because U.S. consumers typically prefer a white fillet, the bloodline must be removed during processing.

Export markets

Ecuador has penetrated the U.S. market – mostly through the Miami airport – with a high-quality product, successfully competing in volume and quality with the strongest tilapia producers. From less than 10 metric tons (MT) in 1993, Ecuador reached 960 MT of exports in 1996.

Two years of negative growth (8 percent and 14 percent) in exports followed, attributed to the successful management of Taura Syndrome Virus by shrimp farmers. But by 1999, with the appearance of White Spot, the conversion from shrimp to fish or polyculture led to the current increase in tilapia production.

In 1999, Ecuador exported 2,012 MT of combined fresh and frozen fillets and whole frozen tilapia, at a total value over U.S. $10 million. The year 2000 was another record year, when exports reached 3,450 MT and a value of U.S. $22.8 million. These figures exceeded exports from Costa Rica, which until then was the most important fresh fillet supplier to the U.S. market.

Conclusion

The Ecuadorian tilapia industry has successfully established itself in the export market in a few years. By maximizing its existing shrimp-culture infrastructure to include tilapia, Ecuador responded to shrimp disease problems in such a way that it is now a top exporter to the growing tilapia market in the United States. Additional strategies for marketing and commercialization will probably be key factors that allow this sector to grow in a sustainable manner.

(Editor’s Note: This article was originally published in the December 2001 print edition of the Global Aquaculture Advocate.)

Now that you've reached the end of the article ...

… please consider supporting GSA’s mission to advance responsible seafood practices through education, advocacy and third-party assurances. The Advocate aims to document the evolution of responsible seafood practices and share the expansive knowledge of our vast network of contributors.

By becoming a Global Seafood Alliance member, you’re ensuring that all of the pre-competitive work we do through member benefits, resources and events can continue. Individual membership costs just $50 a year.

Not a GSA member? Join us.

Authors

-

César C. Alceste

Vice President of Project Development

BioCepts International, Inc.[109,111,99,46,115,116,112,101,99,111,105,98,64,101,116,115,101,99,108,97]

-

Jorge A. Illingworth

Executive Director of the National

Chamber of Aquaculture of Ecuador

Guayaquil, Ecuador[109,111,99,46,114,111,100,97,117,99,101,45,97,110,99,64,104,116,114,111,119,103,110,105,108,108,105,106]

Tagged With

Related Posts

Health & Welfare

Brazil study: Beta-glucans improve survival of IMNV-infected white shrimp

Authors examined whether beta-glucans extracted from bakers yeast could improve the survival and growth of Pacific white shrimp challenged with infectious myonecrosis virus.

Health & Welfare

Dangers of viral pathogens in translocated shrimp, Part 1

Translocated shrimp have the potential to carry pathogens to new areas. Shrimp have a tendency to carry persistent infections without showing signs of disease.

Aquafeeds

Functional ingredients driving shrimp feed innovation

Functional ingredients and additives promote growth, improve health of farmed shrimp, and bolster immune response and other physiological needs.

Health & Welfare

Advances in technology for shrimp virus detection

Shrimp virus detection requires innovative options in tools for viral diseases, such as polymerase chain reaction and isothermal nucleic acid amplification.