Entrepreneurs, innovators and investors find meaning in fueling aquaculture’s growth

Larry Feinberg’s path to aquaculture feed winded through the energy industry. The microbiologist was working on the development of new biofuels when the discovery of abundant natural gas resources in North America, and extraction methods like fracking, slowed interest in alternative fuels, along with the associated job opportunities and funding.

Searching for what to do next, Feinberg saw an opening in aquaculture.

“Anyone who really looks into this equation figures out pretty quickly that aquaculture is a tremendous opportunity to feed the world,” Feinberg told The Advocate. “And as we’re making this global change from hunting in the oceans to farming in the oceans, it comes down to feed. Feed is the limiting issue in how this industry grows.”

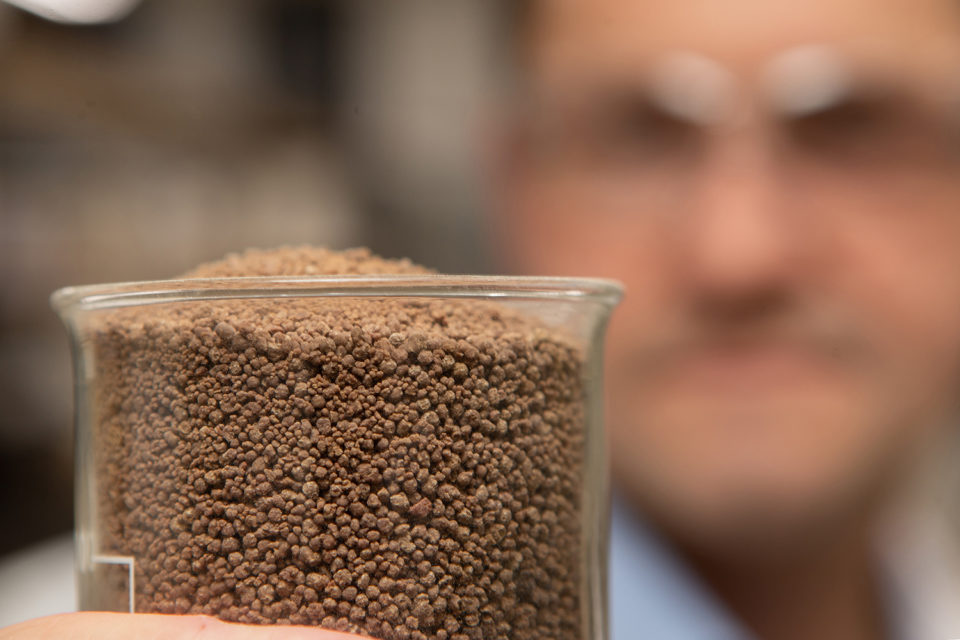

Feinberg co-founded KnipBio in 2013, with the goal of developing a high-protein aquafeed ingredient through fermentation, using the single-cell organism methylobacterium (Methylobacterium extorquens). KnipBio received FDA approval in February, the first of its kind for a single-cell protein. With a background in a seemingly unrelated discipline, Feinberg and his startup company were nevertheless poised to make waves in fish farming.

“That was an overnight success five years in the making,” Feinberg said, adding that commercial products should launch later this year.

And he’s not alone. A number of companies are refocusing away from biofuels and energy security – a hot topic in 2005 – to food security, one of the top concerns today. “It’s a redeployment of that knowledge base,” Feinberg said. “I wish I was so special, but no – I was on the early side of a fairly obvious trend.”

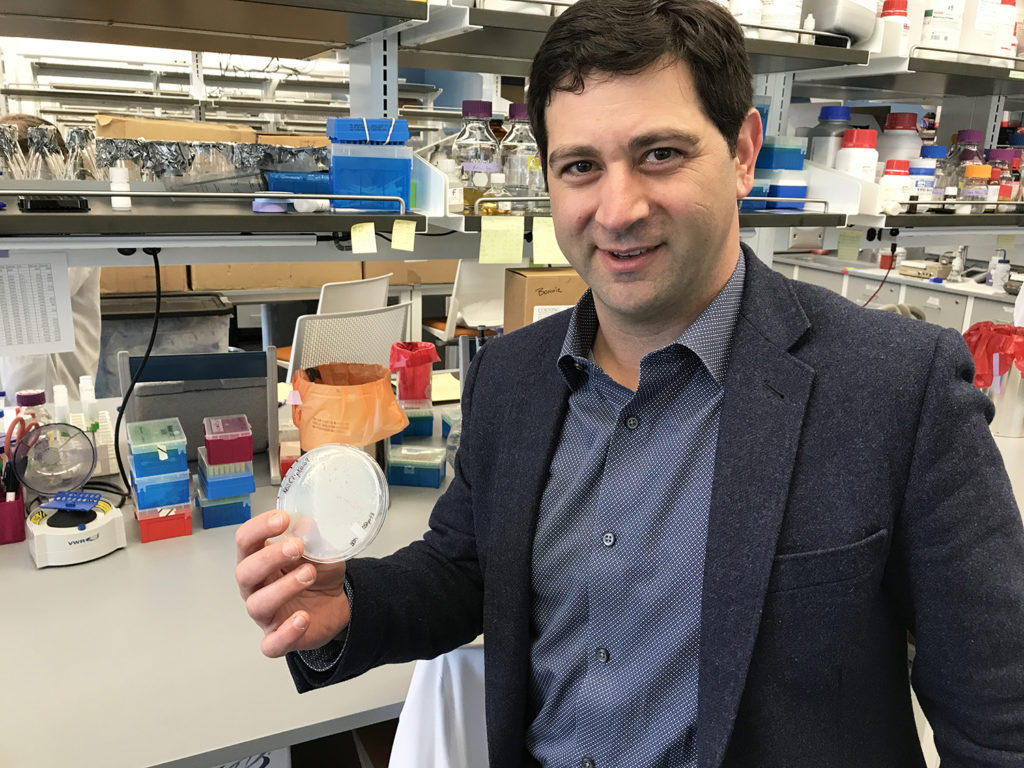

The aquafeed field has seen a recent influx of talent, entrepreneurship and investment, said David Tze, co-founder and CEO of NovoNutrients, a California based company that’s also developing feed ingredients via industrial fermentation.

“In the world of aquafeed ingredients, there’s been a lot more attention from new players, large or small,” said Tze, who operated an aquaculture-focused investment firm Aquacopia until 2016, when he devoted himself full time to NovoNutrients.

Sunil Kadri, who in 2001 founded Aquaculture Innovation, which provides consulting services to numerous aquaculture companies, including an algae producer, agrees. “Today, we’re seeing the large feed companies increasingly investing in joint ventures or even directly in alternative protein and oil sources,” Kadri said. “And at a niche level, at least, we’re seeing farmers embracing these alternatives.”

Increasing investment

Examples include Veramaris’ opening of a plant in Blair, Nebraska, in June to produce omega-3 fatty acids from marine algae for fish feed, as well as BP’s recent $30 million investment in alternative-protein producer Calysta. At the same time, competitions like the F3 Challenge and FeedX have helped stimulate interest.

“I think it’s huge,” said Alan Shaw, president, CEO, and co-founder of Calysta. “The truth is, the market opportunity is bigger than one company, and there’s room for a lot of people.”

What’s driving the trend? Rising and fluctuating costs of inputs like fishmeal and fish oil, and growing concern about sustainability and food security are both factors.

The year 2012 was a turning point, according to Kadri. That year, more people ate fish from aquaculture than from the wild for the first time, and farmed fish also overtook farmed beef in global production.

“We were kind of like a little club that nobody knew about, but those things grabbed attention, and not only did we start to get some big corporations investing in aquaculture – like Lockheed Martin and Mitsubishi – but we also got all these innovators and entrepreneurs looking at aquaculture as a potential market,” Kadri said.

“The problem is that we need to meet the protein needs of 9 billion people in a way that is affordable, healthy, and good for the environment,” added Shaw. “Everything is being driven by what we call the protein gap.”

Aquaculture has the potential to be a leader in filling that gap, but the bottleneck is feed, Shaw said. Traditional aquafeed ingredients – fishmeal and soy – are both unsustainable, Shaw said, and have limited capacity to expand with demand.

“We’re not replacing fishmeal, there just isn’t any more fishmeal,” he said. “For the market to grow, you need more feed.”

Price premium?

At the same time as interest in aquaculture and alternative protein was growing, the alternative energy sector was contracting, leading investors and innovators to look for other opportunities.

“With oil prices being low, we’re seeing companies pivoting to producing infrastructure technologies that will feed aquaculture,” Kadri says.

Currently there are four main technologies in the alternative aquafeed space, Kadri notes: fermentation, algae, enhanced soy and other crops, and insects.

Companies like Calysta and KnipBio are banking on bacteria, with Shaw noting that fermentation offers advantages for scalability and consistency. With natural gas as its primary input, fermentation-based proteins like Calysta’s FeedKind can be scaled up without using any arable land and with very little water, he noted.

“We’re also dealing with a consistent input that never changes, and that’s going to be critical,” he said.

A number of aquafeed players are investing in algae, but Veramaris is the first player to attempt producing it at scale, Tze noted. “Algae is hard to grow, and it’s something folks have tried for a long time,” he said. “They were originally developed to produce fuel. It didn’t work out – it was ahead of its time – so those people pivoted into producing oil for aquaculture.”

Another area of interest is improving the quality of crops like soy beans, canola, guar, and barley through processing, selective breeding and genetic modification to produce fish feed that’s more nutritious or offers other benefits.

“There will be decreasing returns on that, but we haven’t hit the wall yet,” Tze said.

Finally, while there’s been plenty of buzz about insects as fish food, scalability and cost of production remain a concern.

The theory that use of alternative proteins allows producers to command higher prices? Tze is skeptical of that. It’s not enough to be sustainable, he said. Products still have to be cost-effective.

“My opinion is, you can’t rely on a green premium for novel ingredients in aquaculture,” he said. “I think everyone is waiting until they can pay the same cost and get the same performance from a green ingredient. They want these novel ingredients to provide a better value, either through lower cost or higher performance.”

Alternative proteins offer better results through customization, based on the nutritional needs of a particular species of fish or shellfish, Tze said.

“We’re getting close to a point where some technology will be able to produce protein meals that are tailored for a specific species, life cycle, or water temperature,” he said.

Market acceptance

One challenge is public skepticism of biotechnology, rooted in mistrust of technologies like genetic modification. KnipBio conducted a focus group to gauge public perception, in which some respondents said they were concerned about lack of transparency. That led Feinberg to publish all scientific results, both positive and negative, speaking at public forums and blogging.

“I think at the end of the day, people actually like technology,” Feinberg said. “They have smartphones and GPS. But food ties into mom and grandma and Thanksgiving. You have to be careful with combining those two.”

With oil prices being low, we’re seeing companies pivoting to producing infrastructure technologies that will feed aquaculture.

Shaw sees access to capital as the biggest challenge to alternative feeds right now. “It’s not the product. People would buy the product. It’s capital to build the plant,” he said. The company is currently scouting locations for its first production facility in Asia. “As the market leader, we need to validate that our technology operates in scale, and the number one thing we need to do is get that plant build and prove we can produce our product Feedkind at an industrial scale.”

While fish of the future may be consuming more alternative foods made from bacteria, algae and even insects, they won’t be alone. The rush to develop novel aquafeeds is part of a broader trend to find alternative foods for livestock, pets and even humans.

“What’s good enough for fish on a protein basis or a fat basis tends to also be more than good enough for every type of thing you’d want to feed – including people,” Tze said. “There’s a great convergence happening, and I think 10 years from now, you’re going to see a lot more fungibility in the types of ingredients that are playing a role in all these nutritional sectors.”

Aquaculture is likely to lead the way in the field of alternative protein, according to Tze, but development of products for human consumption won’t be far behind. “Fish don’t care what they eat, but people do, so I think fish are going to be eating more bacteria sooner than people,” he said. “But I think as vegetarian diets become predominant, and people have had years or decades to get comfortable with eating insects and eating yeast, microalgae, macroalgae and bacteria, that will even out the playing field.”

At KnipBio, Feinberg sees the potential for expansion, but he’s taking a cautious approach.

“The temptation is to go into these other sectors,” Feinberg said. “We know our protein will work in swine and poultry and maybe even human nutrition, but for an early-stage startup like us, it’s a little risky to diversify into other sectors. We’re going to stay focused on aquaculture for the time being.”

Follow the Advocate on Twitter @GAA_Advocate

Now that you've reached the end of the article ...

… please consider supporting GSA’s mission to advance responsible seafood practices through education, advocacy and third-party assurances. The Advocate aims to document the evolution of responsible seafood practices and share the expansive knowledge of our vast network of contributors.

By becoming a Global Seafood Alliance member, you’re ensuring that all of the pre-competitive work we do through member benefits, resources and events can continue. Individual membership costs just $50 a year.

Not a GSA member? Join us.

Author

-

Ilima Loomis

Ilima Loomis (ilimaloomis.com) is a freelance writer in Hawaii who covers science, travel and business.

Tagged With

Related Posts

Aquafeeds

A new nutrient for aquaculture, from microbes that consume carbon waste

Biotechnology firm NovoNutrients aims to produce a line of nutraceutical aquafeed additives as well as a bulk feed ingredient that can supplement fishmeal. Its process includes feeding carbon dioxide from industrial gas to a “microbial consortium” starring hydrogen-oxidizing bacteria.

Aquafeeds

The pink powder that could revolutionize aquaculture

KnipBio, a Massachusetts-based biotechnology startup founded in 2013, is refining the manufacturing process for a promising aquaculture feed ingredient that may one day form the foundation of the food that farmed fish eat.

Responsibility

Aquaculture Exchange: Alan Shaw, Calysta

Turn fuel into animal food? Calysta can do that. The California biotech company is now hoping for greater buy-in from aquaculture, its target market. CEO Alan Shaw talks about the potential of FeedKind and its ambitious plans for 2016 and beyond.

Aquafeeds

After testing new feed ingredients, Thai Union finds reluctant uptake

The company has engaged in feed trials with both algae and microbial meals, before its sustainability director said farmers, “by and large, don’t want it.”