Product quality, trade barriers and traceability remain challenges

Tilapia have come a long way from their humble origins as a source of cheap protein for poor people in developing countries. While retaining its importance for food security and poverty alleviation, the species has also become a ubiquitous item on the menus of affluent consumers in developed countries.

The initial attraction of tilapia culture was due to its ease of production and relatively rapid growthwith fewinputs. The ability of the fish to adapt to a wide range of environments, withstand poor growing conditions, and thrive with minimal feeding also made them an ideal candidate for poor farmers with limited resources.

Although these advantages made tilapia suitable for large-scale commercial production, there were also considerable drawbacks for the early industry. Species-specific growth constraints, size disparity between the sexes, reproduction in ponds that limited growth rates, and the image of tilapia as a “cheap” fish unsuitable for export all prevented its wide adoption.

International markets

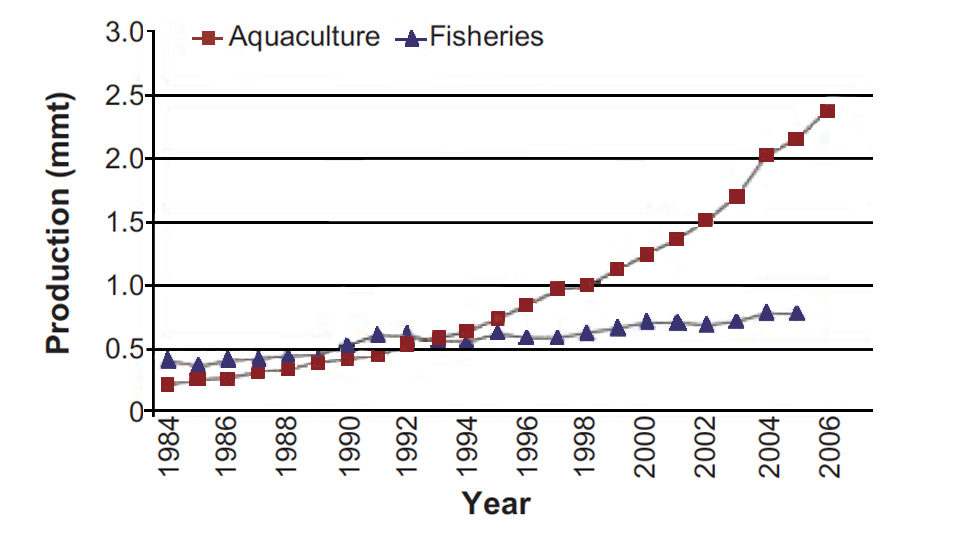

This situation began to change in the 1990s, when tilapia production from farming exceeded that from the capture fishery (Fig. 1). Selective-breeding programs for tilapia also removed some of the constraints to commercial production. Hybrid tilapia strains exhibited improved growth characteristics, and the development of monosex technologies removed the problems associated with unwanted reproduction. This opened the door for more reliable production and the entry of tilapia into the international market.

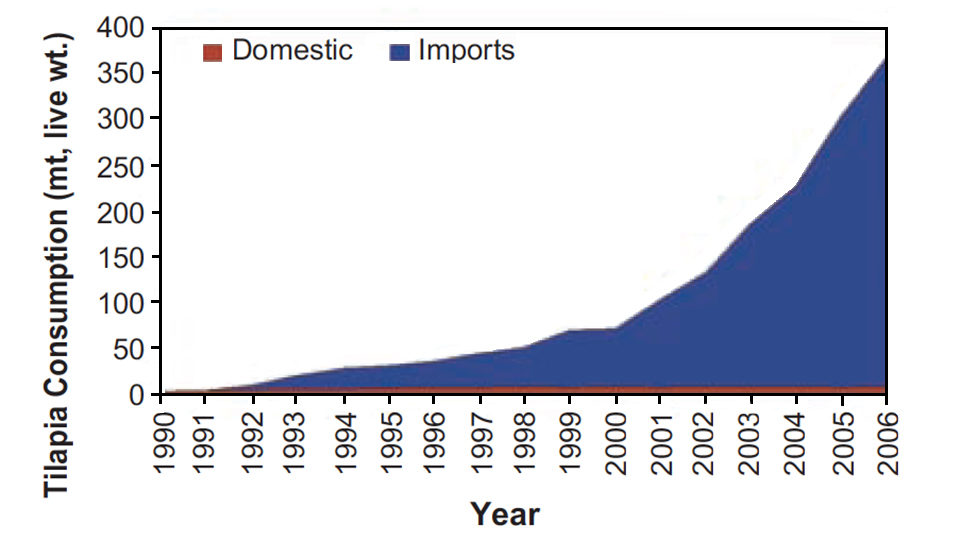

Annual United States imports of tilapia have grown dramatically since the late 1990s from around 50,000 metric tons (MT) to over 350,000 MT. Tilapia consumption per capita also increased from 0.18 kg in 2001 to around 0.45 kg in 2006, placing tilapia above catfish in U.S. per-capita consumption.

Europe has been slower to adopt tilapia as an import product, as it is a relatively late entrant and as a frozen fillet enters a crowded market segment with competition from pangasius and other white fish species. Current European imports hover around 10,000 MT per year, although there is increased marketing of tilapia to a high-end, high value market for prepared and ready-to-eat products.

New challenges

Tilapia’s reputation as a benign aquaculture species with few negative environmental and social issues is enviable. However, the development of significant global trade in tilapia exposes exporters to the same demands for traceability and accountability faced by other seafood suppliers. Tilapia exporters are learning from the experience of other seafood producers so they can maintain the perception of tilapia as a “green” species.

The early adoption of measures to ensure sustainability and implement traceability and certification should forestall the negative publicity experienced by producers of other aquaculture species in the recent past. In addition, avoiding confusing publicity about which tilapia is better or safer should help maintain consumer confidence.

The recent furor over the use of carbon monoxide to preserve the appearance of tilapia fillets is a case in point. Modified-atmosphere packaging has been used by the meat industry for years to preserve the fresh appearance of meat. Carbon monoxide “fixes” the red color of beef, improving its appearance, and the same approach has been used for tilapia.

This practice has been called into question before a U.S. congressional committee as a possible food safety hazard. The use of emotive references to “gassing tilapia” and using a poisonous ingredient could generate negative publicity that drives consumers and regulators to avoid tilapia entirely rather than trying to ascertain exactly how it was processed.

Food safety

Food safety is a key area of concern for seafood buyers. Tilapia were expressly omitted from the recent list of seafood exported from China detained for entry to the U.S., but it is important that tilapia producers understand the negative market impacts that could result from reports of chemical residues or claims of improper use of drugs and chemicals in tilapia production.

Despite claims that tilapia, a hardy species, have a low risk of diseases requiring treatments, these fears are not unfounded. In recent years, banned substances have turned up in tests of tilapia imported into major markets. Antibiotic residues, including chloramphenicol, nitrofurans, tetracyclines, and fluoroquinolones, as well as chemical residues such as malachite green and Gentian violet, have occasionally been reported.

Widespread problems caused by Streptococcus species have led tilapia farmers to experiment with antimicrobials to reduce the losses caused by this disease. Lax enforcement of regulations and easy access to veterinary medicines intended for livestock mean that farmers can apply antimicrobial treatments relatively easily. Unfortunately, they sometimes lack sufficient knowledge of disease management and appreciation of the potential for chemical contamination of the fish to make informed decisions. Vaccines would provide an important alternative, but doubts about their efficiency and cost effectiveness deter farmers from using them.

Product quality

Product quality and consistency are equally important to tilapia buyers. One issue cited by some buyers is the prevalence and unpredictability of off-flavors in the fish. Off-flavor generally results from environmental conditions in culture ponds that lead to the growth of organisms, especially blue-green algae, that produce the geosmin and methylisoborneol responsible for tainted flavors in fish. Occasional contamination of farming environments by pesticides and oil have also been implicated in off-flavors.

Hormone treatment with methyltestosterone for sex reversal of tilapia has been a major factor in the growth of the tilapia industry, as it provides more uniform growth and fewer problems associated with the onset of reproduction in females. This practice is well established, and since the hormone is used briefly in the early life stage of the fish, the potential for residual hormone at harvest is virtually zero.

However, some opponents have focused on the “unnatural” use of hormones for sex reversal rather than the issue of residues. Hormone treatment is specifically proscribed for organic tilapia production, but pressure may be placed on its general use. The replacement of hormone treatments by YY male technology is not yet widespread, however, and the use of estrogen to produce the original YY males may also be an issue.

Trade issues

The massive success of tilapia in international markets has also elevated their profile in terms of trade issues. While this has not yet led to antidumping actions such as those enacted in the United States for imported shrimp and pangasius, several issues have been raised. American tilapia producers have seen their businesses suffer from the flood of cheaper, imported products from Asia (Fig. 2) and formed the American Coalition for Tilapia to promote fresh tilapia produced in the Americas.

In addition to the carbon monoxide issue mentioned above, frozen tilapia fillets have been reportedly mislabeled as fresh tilapia or red snapper for use in the lucrative sushi and sashimi market. As a result, the issue of misleading labeling has been raised in the United States.

Looking further ahead, concerns about animal health and welfare, especially in the European Union, could potentially impact international trade. Calls for the ethical and humane treatment of farmed animals to reduce undue suffering and stress in farms and slaughterhouses have also been extended to the treatment of farmed fish. Several studies have been initiated to establish the effects of production, handling, and slaughter on stress and pain in fish.

The Federation of European Aquaculture Producers has highlighted the potential for fish welfare to disrupt trade. If specific legislation is passed to require European producers to safeguard fish welfare, it is highly likely there would be significant pressure to require imported fish sources to meet the same standards.

Traceability

As farmed seafood has become more available, it is also being held to high standards of traceability and accountability for the food chain. Failure to implement traceability systems or provide adequate safeguards for tilapia may ultimately limit market access and opportunities.

Implementation of such systems poses a particular challenge to small-scale producers and favors larger, vertically integrated operations. This is likely to have profound impacts on some exporting countries’ industries and further widen the gap between small- and large-scale operations.

Certification

Many groups are working on certification programs to promote and demonstrate compliance with principles of good management. Unfortunately, the competition between different groups carries the risk of undermining all attempts at certification. Ultimately, buyers want consistency and accountability so they and their customers can be assured of the credibility and value of certification.

Certification schemes usually add value when they are exclusive, allowing certified producers to obtain a premium price to offset the additional costs and efforts needed to comply. If they become a basic requirement for export, they can act as a barrier to entry through increasing production costs, potentially distorting trade. Certification compliance and administrative difficulties pose particular problems for small-scale farmers.

Value-adding

As with other products where competitiveness is an issue, innovation and versatility in the marketing of tilapia products will be important factors for business success. Value-added processing of individually quick frozen fillets, ready-to-cook forms, and frozen meals has already been an important part of tilapia’s increasing market in the United States. In Thailand, innovative marketing and branding of tilapia as “Pla Tubtim” or “ruby fish” gives the hybrid red tilapia a premium price over Nile tilapia in the domestic market.

Apart from the tilapia themselves, byproducts such as leather made from the skin have been successfully promoted. Items such as purses, wallets, belts, and even bikinis and other clothing can be made from tilapia leather, providing additional income from what previously would have been regarded as waste materials. A more unusual byproduct is incorporation of omega-3 oils from tilapia in fortified orange juice.

(Editor’s Note: This article was originally published in the January/February 2008 print edition of the Global Aquaculture Advocate.)

Now that you've reached the end of the article ...

… please consider supporting GSA’s mission to advance responsible seafood practices through education, advocacy and third-party assurances. The Advocate aims to document the evolution of responsible seafood practices and share the expansive knowledge of our vast network of contributors.

By becoming a Global Seafood Alliance member, you’re ensuring that all of the pre-competitive work we do through member benefits, resources and events can continue. Individual membership costs just $50 a year.

Not a GSA member? Join us.

Authors

-

Daniel Fegan

Cargill Animal Nutrition

Regional Technical Manager–Aquaculture

Bangkok, Thailand[109,111,99,46,108,108,105,103,114,97,99,64,110,97,103,101,102,95,108,101,105,110,97,100]

-

Kevin Fitzsimmons, Ph.D.

Secretary, Treasurer

American Tilapia Association

Professor

University of Arizona

Tucson, Arizona, USA

Tagged With

Related Posts

Health & Welfare

A look at tilapia aquaculture in Ghana

Aquaculture in Ghana has overcome its historic fits and starts and is helping to narrow the gap between domestic seafood production and consumption. Production is based on Nile tilapia.

Responsibility

Addressing safety in Latin America’s tilapia supply chain

Over the last decade, the experience gained by many tilapia farmers combined with proficient programs implemented by local governments have significantly improved tilapia production in various Latin American countries like Colombia, Mexico, Ecuador and other important tilapia producers in the region.

Health & Welfare

Sizing up TiLV and its potential impact on tilapia production

An international research effort has commenced to find a solution for Tilapia Lake Virus (TiLV), a contagion causing high rates of mortality in farmed and wild tilapia stocks in Israel, Colombia, Ecuador, Egypt and Thailand.

Intelligence

What will it take to make tilapia great again?

Once a darling of the sustainable seafood crowd for its vegetarian diet and potential to feed the world’s growing population, mild-mannered tilapia now has an image problem that may be causing a dip in consumption levels.